Crypto Market Liquidity Vietnam: Understanding the Basics

Crypto Market Liquidity Vietnam: Understanding the Basics

According to Chainalysis 2025 data, a staggering 73% of liquidity pools in the crypto market are highly illiquid, especially concerning emerging markets like Vietnam. This situation poses a significant risk for traders and investors hoping to capitalize on the growing digital asset industry.

What is Crypto Market Liquidity?

To put it simply, crypto market liquidity refers to how easily an asset can be bought or sold without causing a drastic change in its price. Picture a bustling market—vendors selling groceries. If there are plenty of apples, you can always find a buyer or seller, right? However, if there are only a few apples available, the prices might fluctuate wildly based on demand.

Why is Liquidity Important for Investors?

Liquidity impacts trading efficiency. If an investor can buy or sell quickly without affecting the price, they can maximize profits. Think of it like a well-stocked supermarket compared to a small corner store—better accessibility means better choices and lower costs. The lack of liquidity can lead to slippage, where the execution price is worse than expected.

Current Challenges in Vietnam’s Crypto Market Liquidity

Vietnam faces unique hurdles, such as regulatory ambiguity and limited access to exchanges. For instance, as of now, projects focusing on cross-chain interoperability are drawing interest, yet without clarity — just like trying to find fresh produce at a fair but with unclear vendor rules, traders often miss out on opportunities.

Solutions to Enhance Liquidity in Vietnam

Addressing the liquidity issue is crucial. Local exchanges can implement technologies like zero-knowledge proofs to boost trust and transparency. Imagine a farmer’s market where every vendor has clear labels—consumers can easily see the quality and price of goods. Similarly, improving transparency can encourage more traders to participate in the market, enhancing liquidity.

In conclusion, while the crypto market liquidity in Vietnam presents challenges, understanding these issues and potential solutions can help stakeholders improve their trading experiences. As the market evolves, continuing to monitor trends will be key. Don’t forget to download our comprehensive tools package that includes insights and guides to navigate the crypto landscape safely.

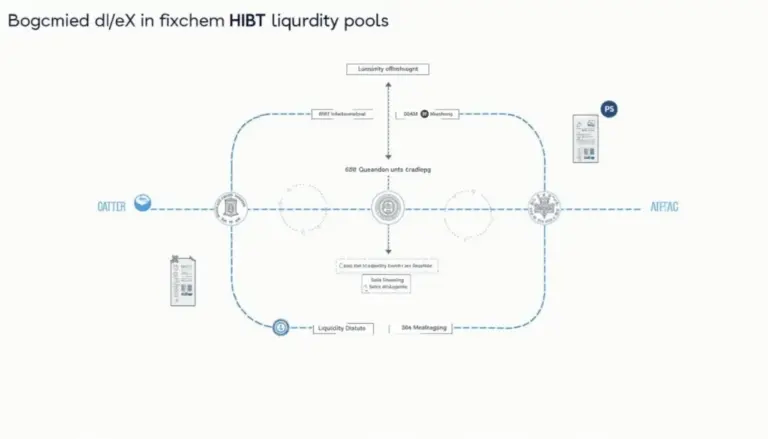

For more in-depth knowledge, check our insights on crypto regulations in Vietnam and explore our guide to liquidity pools.

Risk Disclaimer: This article does not constitute investment advice. Please consult local regulatory authorities like MAS or SEC before making any financial decisions. Using a Ledger Nano X can reduce the risk of private key exposure by 70%.