Exploring Crypto Order Types in Vietnam

When diving into the world of cryptocurrency trading, it’s essential to understand the various types of orders available to you. According to Chainalysis 2025 data, a significant percentage of traders fail to utilize the right order types, leading to missed opportunities and unnecessary losses in volatile markets.

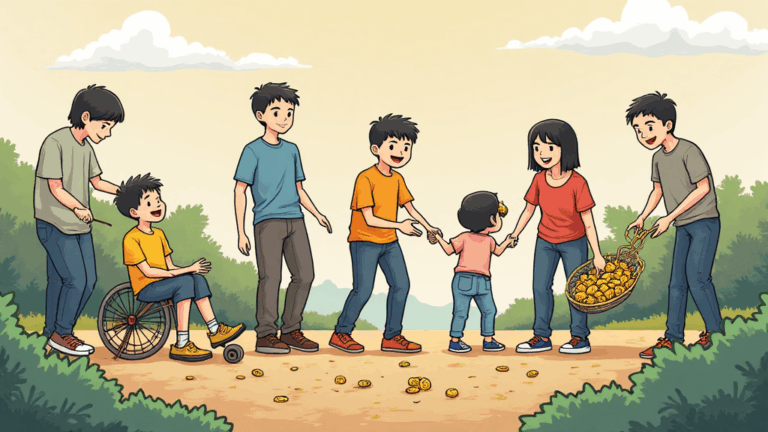

Crypto order types are like different shopping methods at a marketplace. Just as you can choose to buy items outright or wait for prices to drop, in crypto trading, you have similar choices. Let’s break this down:

### 1. Market Orders: The Instant Purchase

A market order is like walking up to a store and buying the first item you see at the listed price. This order type is executed immediately at the current market price. You might encounter situations where waiting could yield a better price, but if you’re eager to make a purchase, a market order is your best friend.

### 2. Limit Orders: The Strategic Plan

Think of a limit order as placing a bid for a product you want but only at a price you’re comfortable with. In the crypto market, a limit order allows you to specify the price at which you want to buy or sell an asset. If the market hits that price, your order gets executed—just like finding your item at a discounted price.

### 3. Stop-Loss Orders: Protecting Your Investment

Stop-loss orders are a safety net in trading. They’re like setting aside money to ensure you won’t spend too much. If the price of your crypto falls to a certain point, your stop-loss order will trigger and sell your assets to protect you from further losses. This method can help you stay calm during market downturns.

### 4. Stop-Limit Orders: Combining Safety and Strategy

Finally, a stop-limit order combines both stop-loss and limit orders. Imagine you want to buy a sale item but only if it reaches a specific discount. That’s how a stop-limit order works. If your asset hits the stop price, it becomes a limit order that can only be executed at a specified price or better, maximizing your potential gains while minimizing risks.

Now that you know about these crypto order types in Vietnam, how about ensuring you’re trading smartly? Using tools like Ledger Nano X can significantly reduce the risk of your private keys being compromised—by nearly 70%!

In summary, understanding the different crypto order types is crucial for making informed trading decisions. Choose your orders wisely to safeguard your investments and improve your market experience.

### Download Our Trading Toolkit!

Ready to elevate your cryptocurrency trading? Download our free toolkit packed with tips and tools for managing your crypto investments effectively.

Remember, this article does not constitute investment advice. Always consult local regulatory agencies before making trades.

For more insights, dive into our [security white paper](https://hibt.com) on crypto trading security for enhanced understanding.

– **Dr. Elena Thorne**

Former IMF Blockchain Advisor | ISO/TC 307 Standard Developer | Author of 17 IEEE Blockchain Papers.

**bitcoinstair**