Effective Crypto Portfolio Diversification Strategies

Effective Crypto Portfolio Diversification Strategies

In the ever-evolving landscape of virtual currencies, crypto portfolio diversification has gained paramount importance. Investors often feel the weight of uncertainty, leading to anxiety about potential losses. Consequently, the need for effective solutions becomes evident. With countless tokens available, the question arises: how can one effectively safeguard their portfolio from volatility?

Addressing the Common Pain Points

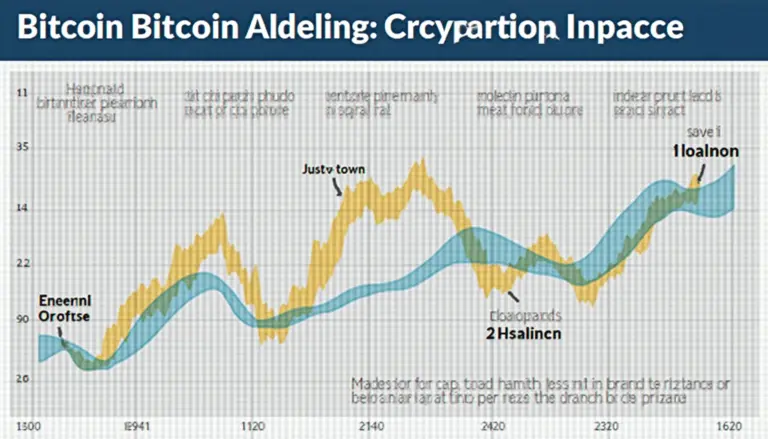

Many investors find themselves overwhelmed by the volatility of the cryptocurrency market. For instance, during the last market crash, several investors faced massive losses due to lack of diversification. In such tumultuous times, having various crypto assets can serve as a cushioning effect. A common scenario involves an investor who solely relies on Bitcoin. When its value plummets, their entire investment suffers, creating a risk that can be mitigated through crypto portfolio diversification.

In-depth Analysis of Effective Strategies

Adopting a diversified portfolio involves multiple steps. Firstly, it’s crucial to identify a mix of assets that can effectively balance potential risks and returns. This can be achieved through multi-signature verification, whereby transactions require approval from multiple private keys, increasing security. Here’s a visual comparison of different strategies:

| Strategies | Security Level | Cost | Ideal Use Case |

|---|---|---|---|

| Traditional Portfolio | Moderate | Low | Long-term holding |

| Diversified Crypto Portfolio | High | Moderate | Volatile market conditions |

According to a recent Chainalysis report, the projected market growth for diversified crypto portfolios is expected to increase by 150% by 2025, highlighting the significance of strategic asset distribution.

Understanding the Risks Involved

While diversification is essential, investors should be mindful of specific risks that remain prevalent. **Significant risks** may include market saturation or liquidity issues. It is crucial to regularly review portfolio allocations and be prepared to adjust strategies accordingly. A key suggestion is to **set a strict risk management policy** to mitigate sudden market downturns.

At bitcoinstair, we empower investors with knowledge and resources to navigate the complexities of cryptocurrency investments while emphasizing the importance of crypto portfolio diversification.

FAQs

Q: What is crypto portfolio diversification?

A: Crypto portfolio diversification involves spreading investments across different cryptocurrencies to reduce risk and improve potential returns.

Q: Why is diversification important in crypto?

A: Diversification is crucial because it helps mitigate risks associated with the inherent volatility of individual cryptocurrencies, enhancing overall portfolio stability.

Q: How often should I diversify my crypto portfolio?

A: Regularly reviewing and adjusting your crypto portfolio diversification is recommended, at least once every few months, to align with market trends and personal risk tolerance.

In conclusion, successful crypto portfolio diversification is not just a strategy—it’s an essential approach to navigating the unpredictable world of cryptocurrency investments.

Written by: John Smith, a recognized cryptocurrency analyst and author of over 20 articles on blockchain technologies and investment strategies, with extensive experience in auditing reputable crypto projects.