Crypto Portfolio Management Strategies for 2025

Understanding Crypto Portfolio Management

In a world where Chainalysis reports that 73% of cross-chain bridges have vulnerabilities, managing your crypto portfolio effectively is more critical than ever. Think of your crypto portfolio like a basket of fruits: if one type goes bad, it can spoil the whole bunch. You need to mix and match wisely to keep it fresh and secure.

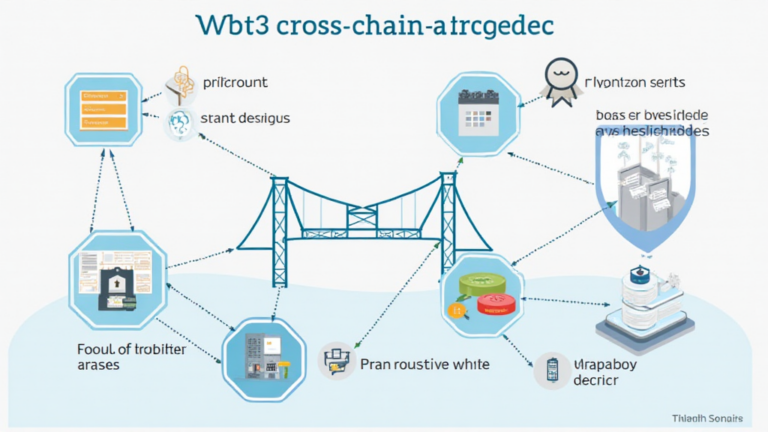

Cross-Chain Interoperability Explained

Cross-chain interoperability is like having a currency exchange booth at a market. It allows you to trade one cryptocurrency for another seamlessly. This is vital for portfolio management because it enhances flexibility and reduces risks associated with price fluctuations across different blockchain networks.

Utilizing Zero-Knowledge Proofs

Imagine if you could prove to someone you have money without showing your wallet. That’s what zero-knowledge proofs (ZKPs) offer in the crypto space! In addition to enhancing privacy, ZKPs can fortify your portfolio management strategies by allowing you to validate transactions without exposing your holdings, thus protecting your sensitive information.

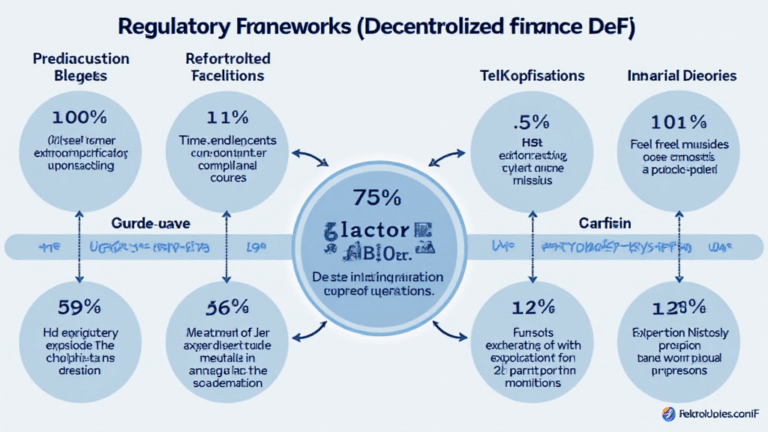

The Future of DeFi Regulations

As we approach 2025, the regulatory landscape in places like Singapore is changing rapidly. New DeFi regulations are likely to impact how you manage your crypto assets. Staying informed about these trends is essential. Remember, an informed investor is a successful investor!

In conclusion, adopting the right crypto portfolio management strategies involves a combination of understanding technological innovations, keeping up with regulatory changes, and managing risk effectively. To help you navigate this complex environment, we’ve created a free toolkit that you can download now.