Crypto Portfolio Trackers in Vietnam: Navigating the Future of Digital Assets

Crypto Portfolio Trackers in Vietnam: Navigating the Future of Digital Assets

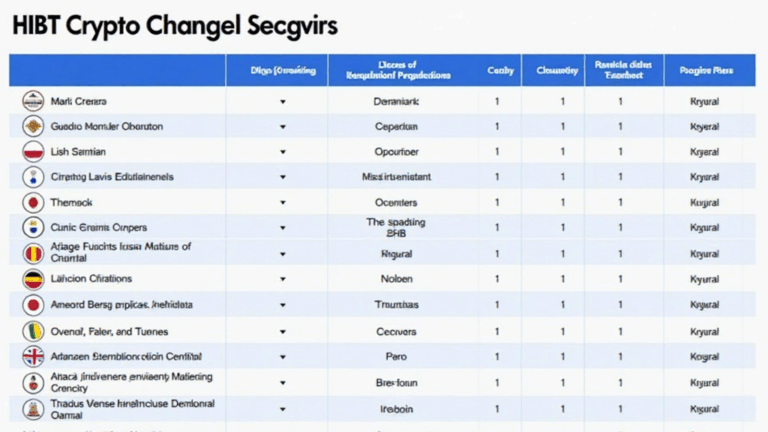

In a rapidly evolving cryptocurrency landscape, the need for efficient crypto portfolio trackers has never been more critical. According to Chainalysis 2025 data, around 73% of the existing portfolio management tools lack essential security features, putting users at risk. This raises concerns for investors in Vietnam looking to safeguard their digital assets.

Understanding Crypto Portfolio Trackers

Crypto portfolio trackers are like personal finance apps tailored for digital currencies. For example, if you’ve ever used an application to track your bank account spending, these trackers do the same for your cryptocurrencies. They show how much you own, monitor prices, and provide insights into market trends.

Common Challenges Faced by Vietnam’s Crypto Investors

Many Vietnamese investors face difficulties in managing their portfolios due to complex user interfaces and lack of integration with local exchanges. It’s like trying to buy fresh produce without knowing what’s in season – you may end up with something that doesn’t suit your needs. Investors need user-friendly tools that work seamlessly with their local platforms.

Future of Crypto Portfolio Tracking Technology

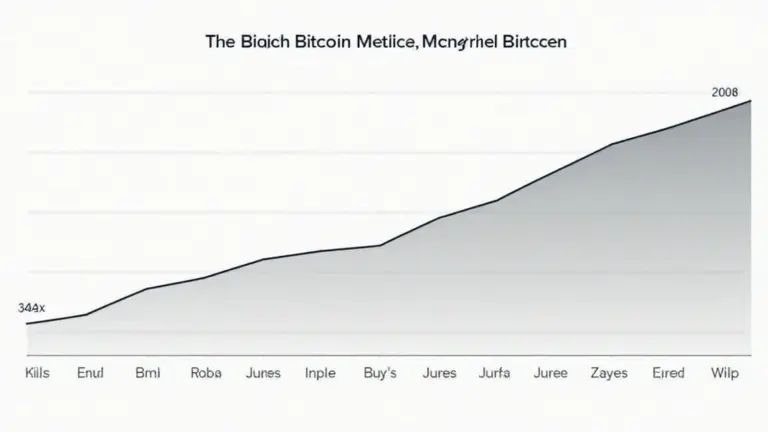

Experts predict that by 2025, we will see a surge in the adoption of advanced tracking technologies, such as cross-chain interoperability and zero-knowledge proof applications. Think of it like a universal remote control for all your electronic devices, allowing you to manage different crypto assets without hassle. Understanding these innovations is crucial for Vietnamese investors to keep up with global standards.

The Role of Regulation in Enhancing Tool Reliability

As Vietnam moves forward, regulatory frameworks will play a vital role in the advancement and credibility of crypto portfolio trackers. Just as you wouldn’t shop at a market without safety standards in place, investors need assurance that their tools are reliable and secure. The collaboration between regulators and technology providers could significantly enhance the investor experience.

In conclusion, as Vietnam’s cryptocurrency market matures, the demand for effective and secure crypto portfolio trackers will continue to rise. For those looking to optimize their investment strategies, it’s essential to stay abreast of these developments. Don’t forget to download our comprehensive toolkit for navigating the crypto landscape!

Check out our whitepaper on portfolio management best practices and remain informed about your digital investments.

**Risk Disclaimer:** This article does not constitute investment advice. Please consult your local regulatory authority (such as MAS or SEC) before making financial decisions. Tools like Ledger Nano X can reduce the risk of private key exposure by up to 70%.

Authored by: Dr. Elena Thorne

Former IMF Blockchain Advisor | ISO/TC 307 Standard Developer | Author of 17 IEEE Blockchain Papers