2025 Crypto Tax Software Comparisons: Your Ultimate Guide

2025 Crypto Tax Software Comparisons: Your Ultimate Guide

As we dive into 2025, the world of cryptocurrency continues to evolve rapidly. According to Chainalysis, an alarming 73% of crypto holders remain uncertain about their tax obligations, putting them at risk for compliance issues. In the fast-paced landscape of digital assets, understanding the nuances of various crypto tax software comparisons is crucial for ensuring proper tax management.

1. Understanding Different Crypto Tax Software Options

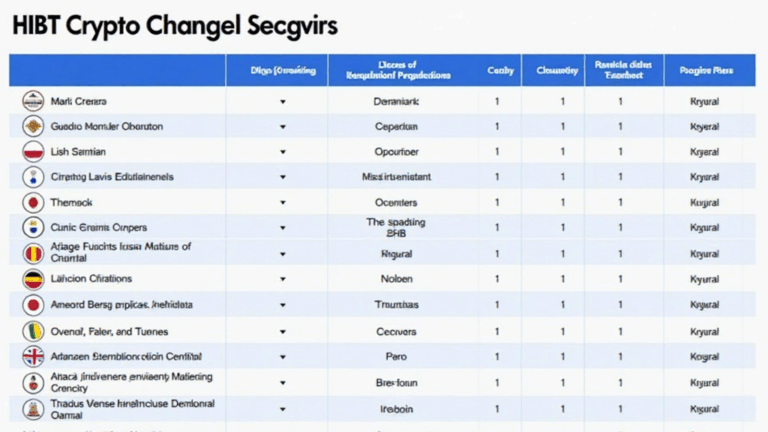

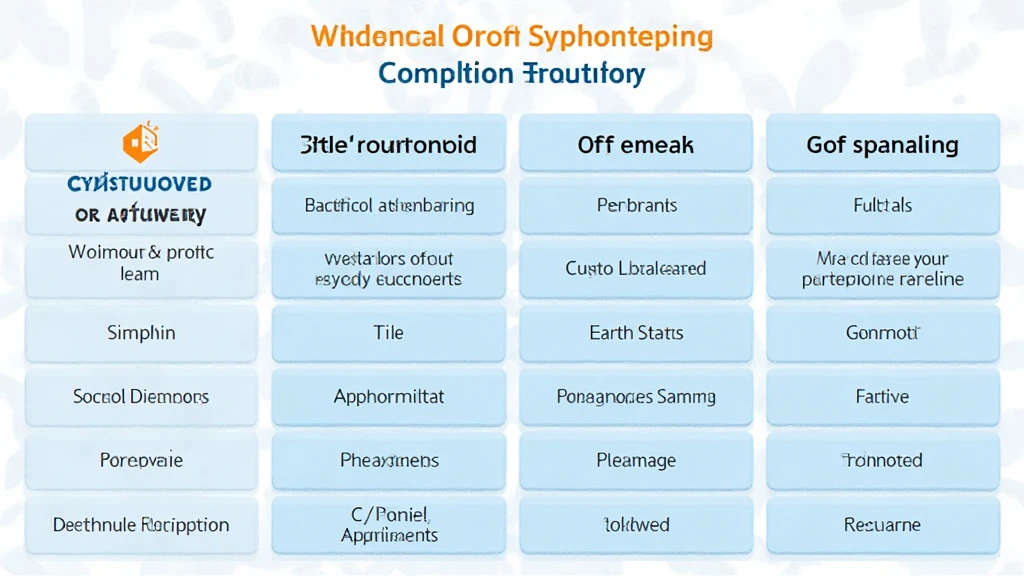

Imagine you’re at a market. Each stall represents different crypto tax software options. Some are better for simple portfolios, while others are tailored for complex investments. Some popular choices for crypto tax management are CoinTracking, TaxBit, and CryptoTrader.Tax. They each offer unique features that cater to different needs, like automated reporting and multi-currency support, making them vital tools in a crypto trader’s toolkit.

2. How to Select the Right Software for Your Needs

Much like choosing the right grocery store based on your budget and needs, selecting crypto tax software requires consideration of factors such as the volume of trades, the complexity of assets, and specific tax regulations in your region (for example, Dubai cryptocurrency tax guide). It is advised to assess reviews and trial versions to ensure the software meets your unique demands without exceeding your budget.

3. Key Features to Look for in Crypto Tax Software

When you’re shopping around for software, think of it like looking for kitchen appliances. You want something that combines usability and efficiency. Features such as automatic transaction import, capital gains calculations, and compliance reporting are essential. An effective software should help decode the complex details of crypto transactions, rendering the tax process smoother than ever.

4. Staying Compliant with Local Tax Regulations

You might have heard stories about someone getting into trouble for unpaid taxes. Understanding local laws is just as critical as selecting the right tax software. For example, regulations in different countries can vary significantly. In 2025, Singapore’s DeFi regulation trends may set a benchmark for compliance standards globally. It’s wise to integrate the chosen software with local guidelines to avoid potential pitfalls.

Ultimately, nearing tax season can feel overwhelming, but with the right tools and knowledge, managing your crypto taxes can be straightforward. Enhance your understanding by downloading our comprehensive toolkit on Crypto tax software comparisons. This will ensure you are prepared for all tax-related challenges that the crypto world throws your way.