Crypto Yield Farming Vietnam: A 2025 Outlook

Crypto Yield Farming Vietnam: A 2025 Outlook

According to Chainalysis data from 2025, a staggering 73% of yield farming platforms expose investors to significant vulnerabilities. This alarming statistic highlights the pressing need for robust security measures especially in emerging markets like Vietnam.

What is Crypto Yield Farming?

Imagine you have a garden, and in that garden, you’re planting various crops. In the world of crypto, yield farming is like planting your money where it can grow. You lend your digital assets to others and, in return, earn interest. But just like with gardening, the right environment is crucial for growth.

Why is Vietnam a Hotspot for Crypto Yield Farming?

Vietnam’s young, tech-savvy population is akin to a bustling marketplace, eager to explore innovative financial solutions. As digital currencies gain traction, many Vietnamese investors are diving into yield farming, seeking lucrative returns. However, the lack of regulatory clarity can be likened to navigating a murky river; you might find gold, but watch out for hidden rocks!

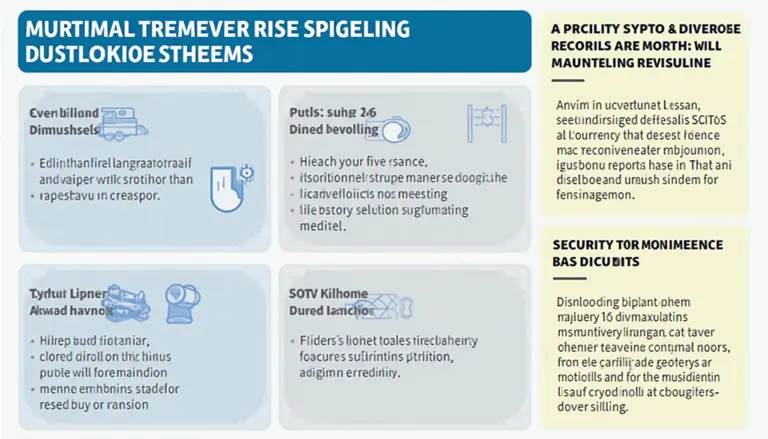

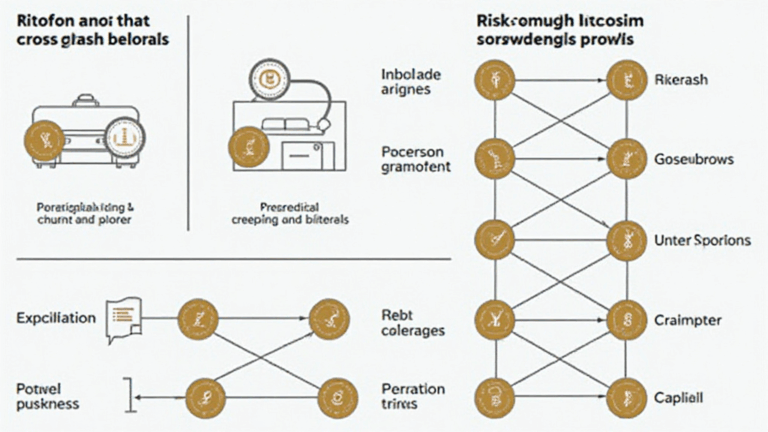

What are the Risks Involved?

In any investment, there are risks. For yield farming, think of it like walking through a crowded bazaar. While there are treasures to find, there are also scams lurking around every corner. The volatility of cryptocurrency prices and potential smart contract failures are significant risks that every investor must know before they jump in.

How to Safely Engage in Yield Farming?

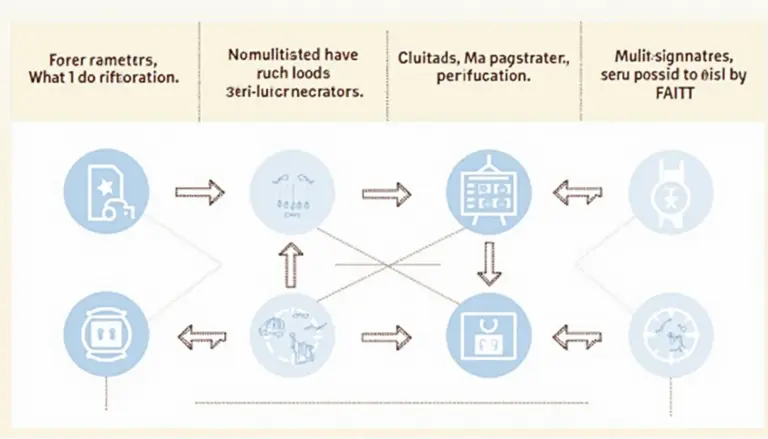

Taking small, calculated steps is the best way to approach yield farming in Vietnam. Start with reputable platforms and conduct thorough research—think of this as reading the ingredients list before eating at a new restaurant. Utilizing tools like Ledger Nano X can significantly reduce risks, making it less likely for your private keys to be compromised.

Conclusion & Download Our Toolkit!

Crypto yield farming in Vietnam presents thrilling opportunities but comes with its own set of challenges. To help you navigate these waters, we invite you to download our exclusive toolkit filled with up-to-date resources and guidelines. Equip yourself with the knowledge needed to thrive in this evolving landscape!

Please note that this article does not constitute investment advice. Always consult your local regulatory authority, such as the Ministry of Finance in Vietnam, before engaging in cryptocurrency activities.

For more insights into the world of cryptocurrency, check out our Yield Farming White Paper and Security Audit Guide. Stay informed with our research section.

Authored by: Dr. Elena Thorne

Former IMF Blockchain Advisor | ISO/TC 307 Standards Creator | Published 17 IEEE Blockchain Papers