Navigating Cryptocurrency Exchange Compliance

Introduction

With over $4.1 billion lost to DeFi hacks in 2024, ensuring cryptocurrency exchange compliance has never been more critical. The rapidly evolving regulatory landscape underscores the necessity for crypto platforms to adopt robust compliance measures. This article aims to guide you through the various aspects of compliance relevant to cryptocurrency exchanges, helping you safeguard your digital investments.

The Importance of Cryptocurrency Exchange Compliance

Compliance in the cryptocurrency space is akin to securing a bank vault for digital assets. Regulatory bodies across the globe are scrutinizing exchanges to protect consumers and ensure market integrity. In countries like Vietnam, user growth for cryptocurrencies has surged by an astonishing 60%, emphasizing the need for exchanges to align with compliance standards.

Key Compliance Standards

- Know Your Customer (KYC): This involves verifying the identities of users to prevent fraud and money laundering.

- Anti-Money Laundering (AML): Exchanges must implement processes to monitor transactions and report suspicious activities.

- Data Protection: With users storing vast amounts of wealth, exchanges must adhere to data privacy regulations.

Challenges in Compliance

You’ll find that maintaining compliance can be a challenging task for many cryptocurrency exchanges. Here’s a breakdown of some common obstacles:

- Rapid regulatory changes across different jurisdictions.

- Lack of standardized compliance frameworks.

- Difficulty in tracking cross-border transactions.

Leveraging Technology for Compliance

To overcome compliance challenges, many exchanges are turning to advanced technologies. Tools such as blockchain analytics and AI-driven KYC solutions can enhance compliance measures significantly, providing real-time monitoring of transactions and user behavior.

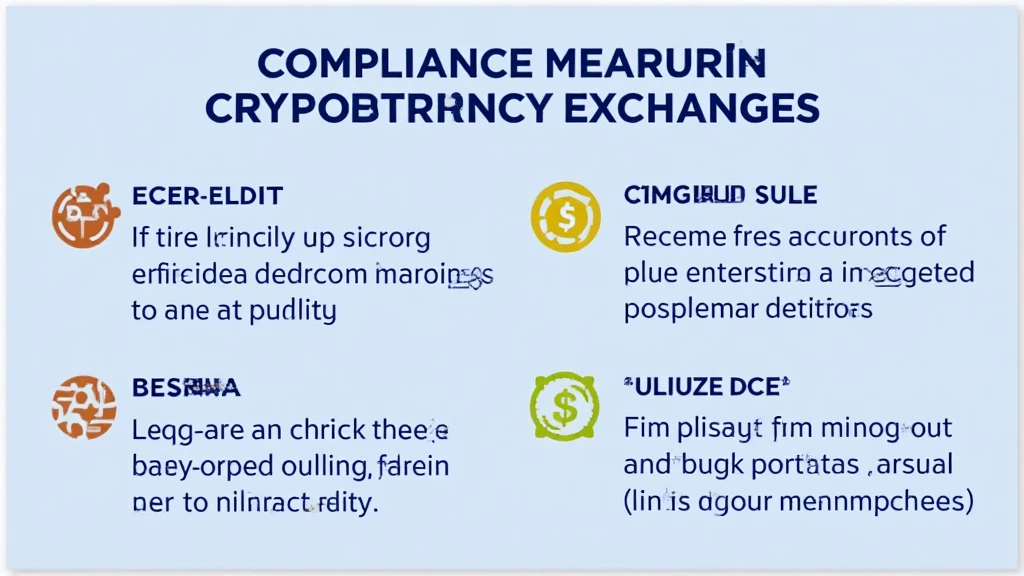

Best Practices for Ensuring Compliance

Here’s the catch: proactive compliance is more effective than reactive measures. Consider these best practices to ensure your cryptocurrency exchange stays on the right side of regulations:

- Regularly update your compliance program based on changing laws.

- Implement robust training for staff on compliance protocols.

- Utilize third-party compliance audits for an unbiased evaluation.

Real Data Insights

According to Chainalysis, exchanges that adopted stricter compliance measures saw a 40% reduction in fraud-related incidents in 2025. This statistic underscores the importance of an ongoing commitment to compliance.

Conclusion

Cryptocurrency exchange compliance is a vital aspect of operating in a highly competitive and regulated market. As the digital currency landscape continues to evolve, integrating sound compliance practices will not only protect users but also enhance the credibility of your platform. Platforms like bitcoinstair provide extensive resources for ensuring compliance in the cryptocurrency space. Stay informed, stay compliant, and ensure the security of your digital assets as you navigate this exciting yet complex industry.