Understanding Cryptocurrency Fundamental Analysis

Introduction

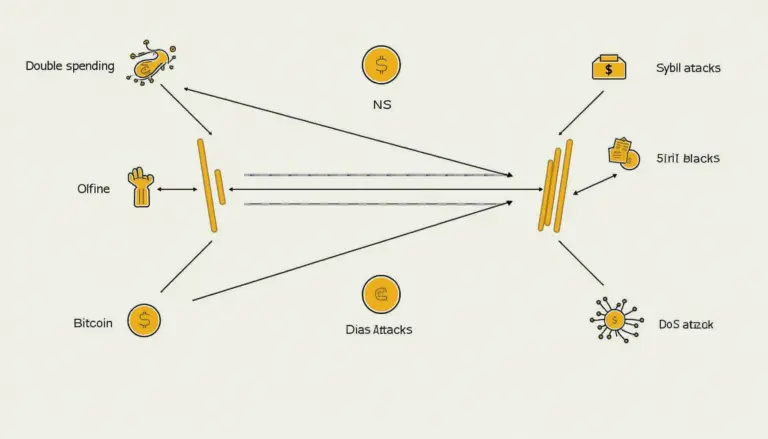

With over $4.1B lost to DeFi hacks in 2024, understanding cryptocurrency fundamental analysis has never been more critical for investors and enthusiasts alike. This article delves into the essential components of evaluating digital assets, ensuring you make informed choices in a volatile market.

What is Cryptocurrency Fundamental Analysis?

Similar to analyzing stocks, cryptocurrency fundamental analysis involves evaluating the intrinsic value of a digital asset. It includes assessing various factors such as:

- Technology and use case

- Team expertise and project history

- Market dynamics and community engagement

In Vietnam, over 3.5 million users engaged with cryptocurrencies in 2023, highlighting the importance of thorough analysis in understanding potential risks and rewards.

Key Components of Analysis

1. Technology and Use Case: Analyzing the underlying technology of a cryptocurrency helps gauge its potential. For instance, Ethereum’s smart contract capabilities have made it a go-to platform for developers.

2. Development Team: The expertise of the team behind a cryptocurrency can indicate its future success. Projects led by seasoned professionals with a proven track record are generally more reliable.

3. Market Dynamics: Understanding market demand and supply is crucial. Analyzing trading volumes and community sentiment can offer insights into a coin’s potential.

Evaluating Market Sentiment

Market sentiment can significantly impact a cryptocurrency’s price trajectory. Tools like social media monitoring and sentiment analysis can help gauge public perception. For instance, if positive news is trending about a cryptocurrency, it may signal a potential price surge.

Conclusion

As the volatility of cryptocurrencies continues, utilizing comprehensive fundamental analysis can enhance your investment strategies. By understanding the technology and evaluating market dynamics, you can make informed decisions that align with your financial goals. Remember, not financial advice. Consult local regulators for personal investment strategies. Explore more about cryptocurrency dynamics at hibt.com.

For those in the Vietnamese market, remaining updated on local crypto trends is essential as user growth soared by an impressive 40% last year. As you navigate this exciting space, always utilize fundamental analysis to guide your journey.

For further assistance, check out our in-depth articles on Vietnam crypto tax and how to audit smart contracts.