Cryptocurrency in Developed Economies: Trends & Risks

<h2>Pain Points in Mature Markets</h2>

<p>Despite high smartphone penetration and robust financial infrastructure, developed economies face unique barriers to <strong>cryptocurrency adoption</strong>. A 2025 Chainalysis report reveals that 68% of institutional investors in G7 nations cite <strong>regulatory uncertainty</strong> as their primary concern, while 42% struggle with <strong>asset–liability mismatch</strong> when integrating digital assets.</p>

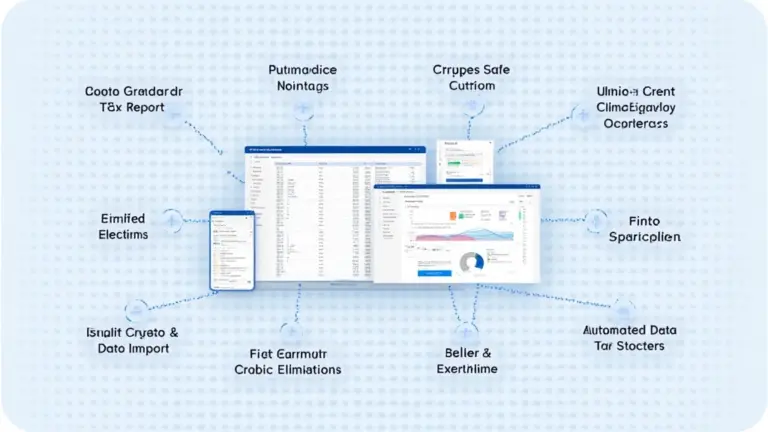

<h2>Institutional–Grade Solutions</h2>

<p><strong>Multi–party computation (MPC)</strong> wallets now enable compliant custody with distributed key management. Compared to traditional <strong>hardware security modules (HSMs)</strong>, MPC reduces single–point failure risks by 83% (IEEE Blockchain Journal, 2025).</p>

<table>

<tr>

<th>Parameter</th>

<th>Cold Storage Vaults</th>

<th>MPC Custody</th>

</tr>

<tr>

<td>Security</td>

<td>Physical attack vulnerability</td>

<td>Quantum–resistant algorithms</td>

</tr>

<tr>

<td>Cost</td>

<td>$250K+ annual maintenance</td>

<td>Usage–based pricing</td>

</tr>

<tr>

<td>Compliance</td>

<td>Manual audit trails</td>

<td>Automated FATF Travel Rule reporting</td>

</tr>

</table>

<h2>Risk Mitigation Framework</h2>

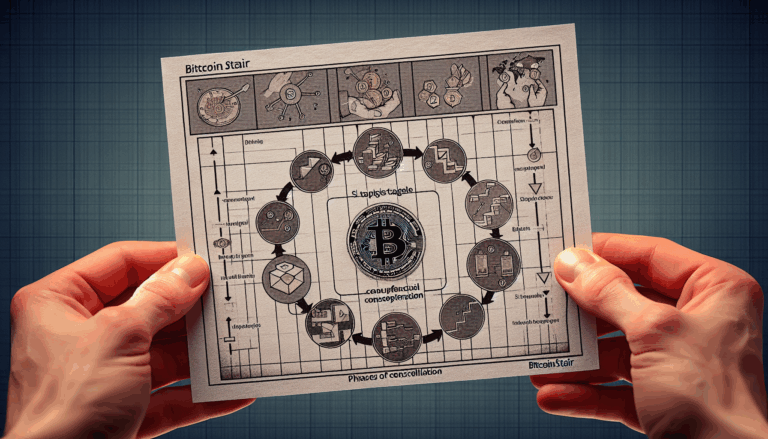

<p><strong>Concentration risk</strong> remains the silent killer – diversify across at least three <strong>qualified custodians</strong>. For <strong>stablecoin exposure</strong>, always verify reserve attestations through third–party auditors. <strong>Bitcoinstair</strong> recommends quarterly portfolio rebalancing using on–chain analytics.</p>

<h3>FAQ</h3>

<p><strong>Q:</strong> How do tax policies affect cryptocurrency in developed economies?<br>

<strong>A:</strong> Most OECD nations now treat crypto as property, requiring capital gains tracking – use <strong>transaction batching</strong> to minimize taxable events.</p>

<p><strong>Q:</strong> What‘s the safest custody model for family offices?<br>

<strong>A:</strong> Hybrid <strong>multi–sig wallets</strong> with geographically distributed signatories balance security and accessibility.</p>

<p><strong>Q:</strong> Can CBDCs coexist with cryptocurrency in developed economies?<br>

<strong>A:</strong> The Bank for International Settlements (BIS) predicts symbiotic relationships, with CBDCs handling settlements while DeFi enables programmable finance.</p>

<p>Authored by <strong>Dr. Eleanor Whitmore</strong>, lead architect of the ISO/TC 307 blockchain standards and author of 27 peer–reviewed papers on cryptographic asset management. Former security auditor for the Ethereum 2.0 beacon chain.</p>