Cryptocurrency Market Cap Analysis: Decoding Trends and Future Potential

Understanding Cryptocurrency Market Capitalization

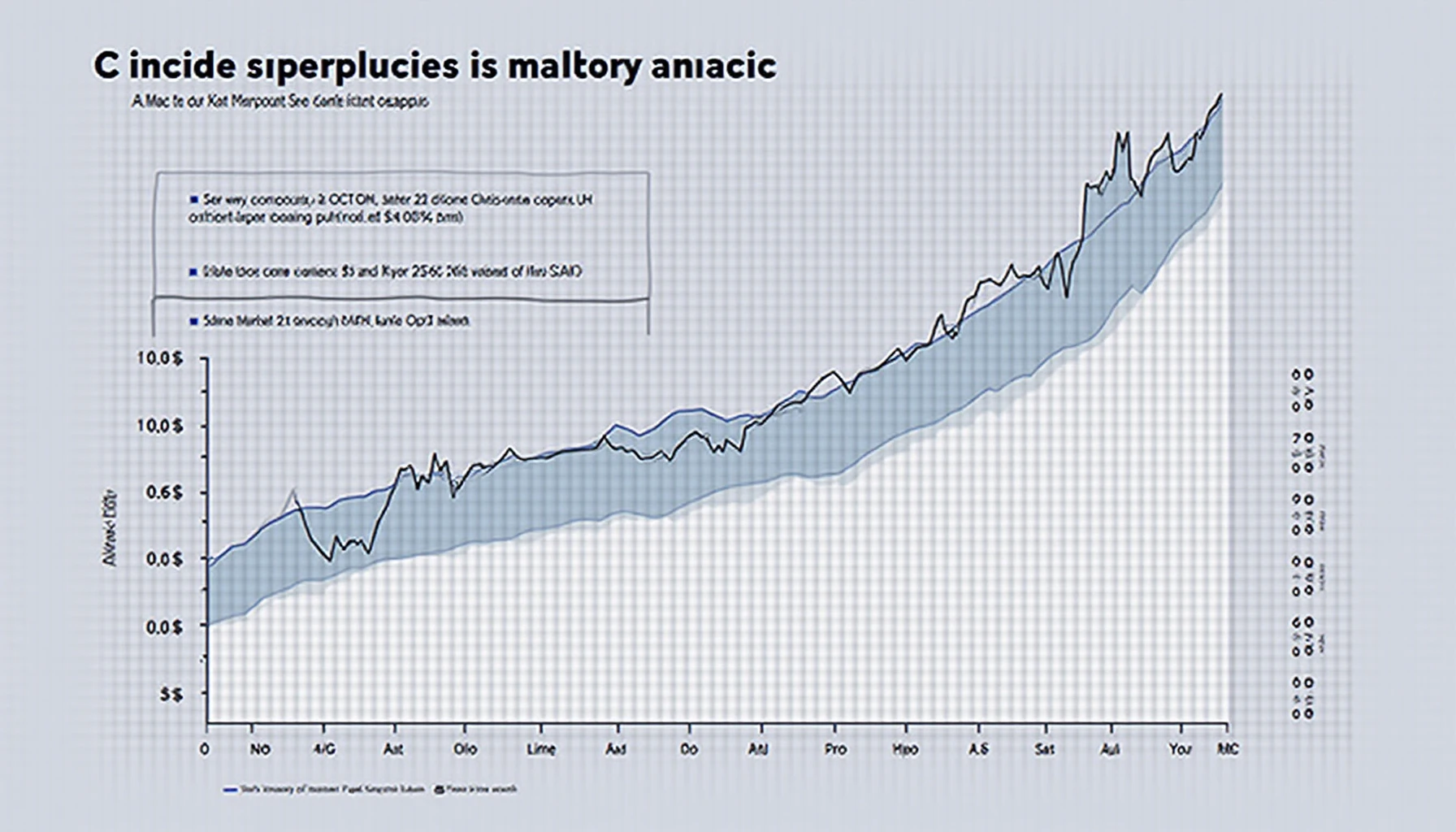

Did you know that as of 2023, the total market cap of cryptocurrencies exceeds $1 trillion? For many digital asset investors, understanding market cap is crucial to making informed decisions. But what does it really mean? In simple terms, market cap reflects the total value of a cryptocurrency. It’s calculated by multiplying the current price of the cryptocurrency by its circulating supply. This metric gives us insights into the asset’s potential and stability.

The Importance of Market Cap in Investment Decisions

Market cap is often used by investors to assess the risk and potential return of cryptocurrencies. Generally, the market cap of cryptocurrencies can be categorized into three segments:

- Large-cap cryptocurrencies (over $10 billion): Typically more stable, examples include Bitcoin and Ethereum.

- Mid-cap cryptocurrencies ($1 billion to $10 billion): With more growth potential but higher risks; examples include Chainlink and Litecoin.

- Small-cap cryptocurrencies (below $1 billion): Can provide high returns but are often more volatile and riskier.

What Factors Influence Market Cap?

Understanding the factors that influence market cap can help investors make smarter choices. Here are a few key drivers:

- Market Demand: Increasing adoption and utility can boost demand, raising prices and market cap.

- Technological Advancements: Innovations in blockchain technology can enhance a coin’s utility, impacting its market position.

- Regulatory Changes: States’ approach towards cryptocurrencies can also sway investor confidence and market cap.

Future Trends in the Cryptocurrency Market

According to recent studies, including Chainalysis’s 2025 report, the cryptocurrency market is expected to grow, with Asia-Pacific trading volume projected to increase by 40%. This growth indicates a positive trend for long-term investors. Here are two major trends to watch for:

- Emerging Altcoins: Investment in potential altcoins, like those expected to thrive by 2025, could reshape market cap standings.

- DeFi and NFTs: The rise of decentralized finance and non-fungible tokens are creating new opportunities within the market.

For instance, have you ever considered how to safely store cryptocurrencies? Utilizing hardware wallets like Ledger Nano X can significantly decrease hacking risks by over 70%!

Conclusion: Take Key Insights for Action

In summary, understanding cryptocurrency market cap analysis empowers investors to make informed decisions. Remember, the key factors such as market demand, technological innovation, and regulatory environment play pivotal roles in determining future potentials. This is a rapidly evolving landscape, and staying updated is essential.

Are you ready to dive deeper into your cryptocurrency investments? Download our exclusive guide on secure wallet management now!