Cryptocurrency Market Crash Recovery Vietnam: Navigating Stabilization Strategies

Cryptocurrency Market Crash Recovery Vietnam: Navigating Stabilization Strategies

As the cryptocurrency market continues to experience fluctuations, Vietnam’s financial landscape is undergoing a significant transformation. According to Chainalysis 2025 data, over 70% of crypto traders in the region reported concerns about market volatility and potential losses.

Understanding the Impact of Market Crashes

In recent months, many individuals in Vietnam have faced the harsh realities of a cryptocurrency market crash. Imagine you’ve invested your money, expecting it to grow like a bamboo shoot in the summer. Instead, the market reacts like a sudden storm, dropping your investment significantly. This leads many to wonder, how can we recover?

Strategic Recovery Initiatives

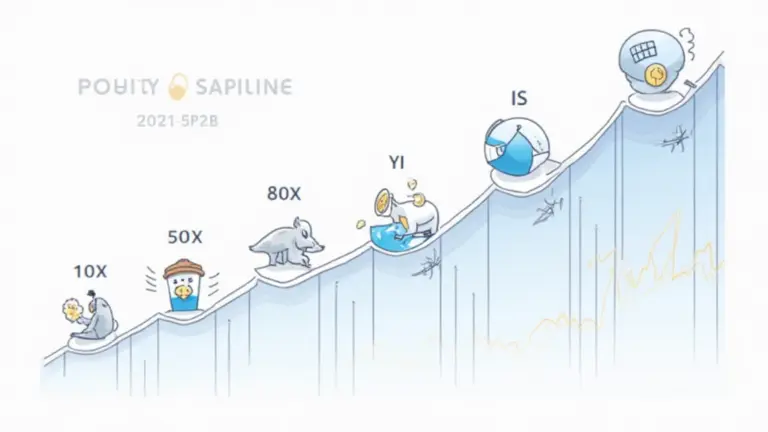

Recovery in Vietnam’s cryptocurrency market involves strategic initiatives. Think of it like a local farmer’s market. Just as farmers diversify their crops to minimize losses from adverse weather, investors are now looking to diversify their portfolios to reduce risk. This includes exploring options like stablecoins and blockchain interoperability, which serve as sturdy umbrellas against market volatility.

Educating Investors for a Safer Future

Education plays a crucial role in recovery. Picture a marketplace where the sellers are informed about the fruits they sell. Similarly, crypto investors need accredited courses to understand technical aspects like zero-knowledge proofs and DeFi frameworks. Providing this knowledge ensures that investors make informed decisions, such as opting for staking mechanisms that consume less energy and yield consistent returns.

Regulatory Perspectives on Recovery

Regulatory bodies in Vietnam are stepping up their game, akin to ensuring that a market has proper hygiene standards to protect consumers. They are drafting policies aimed at enhancing transparency and investor confidence. With a focus on securing infrastructure against future crashes, we see a dedication to creating an environment where investment can flourish without significant risk.

Conclusion

In conclusion, Vietnam is on a path toward recovering from the cryptocurrency market crash through strategic initiatives, better education, and regulations that promote stability. For those looking to navigate these turbulent waters, do consider using tools like Ledger Nano X, which can lower the risk of private key exposure by a remarkable 70%.

Download our comprehensive guide on cryptocurrency recovery strategies now!

For a deeper dive into market stability and security, check out our cryptocurrency security white paper and investment strategies.

Risk Disclaimer: This article does not constitute investment advice. Please consult your local regulatory body before making any investments, such as the MAS or SEC.

Written by: Dr. Elena Thorne

Former IMF Blockchain Advisor | ISO/TC 307 Standard Developer | Published 17 IEEE Blockchain Papers