2025 Cross-Chain Bridge Security Audit Guide

2025 Cross-Chain Bridge Security Audit Guide

According to Chainalysis 2025 data, a staggering 73% of cross-chain bridges exhibit vulnerabilities that could jeopardize assets. As the cryptocurrency landscape evolves, ensuring the security of these bridges has become increasingly critical.

Understanding Cross-Chain Bridges

You might wonder what a cross-chain bridge really is. Think of it like a currency exchange booth where you can swap one type of money for another. Just as some booths may have better rates or hidden fees, not all cross-chain bridges are created equal—some are riskier than others.

The Importance of Security Audits

So, why should you care about audits? Imagine your savings locked in a safety deposit box that’s never been checked for flaws. The longest-running or most user-friendly bridge might still harbor critical weaknesses. A comprehensive security audit can help identify these gaps, ensuring your assets remain safe.

Real-World Examples of Hacks

Unfortunately, plenty of real-life hacks illustrate the dangers of unsecure cross-chain bridges. Just like you’ve probably heard horror stories of wallets being drained, there have been instances where vulnerabilities in bridges led to significant asset losses. Knowing the stories can make you more cautious and better prepared.

How to Choose a Secure Bridge

Choosing the right cross-chain bridge isn’t just about speed or fees. It’s about vetting. When picking your bridge, consider factors like the audit frequency, the team behind it, and recent security evaluations. Like grocery shopping, it helps to know which products have passed quality checks.

For those interested, you can download our detailed security audit toolkit that helps you identify trusted bridges in the Cryptocurrency market data landscape.

Disclaimer: This article does not constitute investment advice. Always consult with your local regulatory authority (such as MAS/SEC) before proceeding.

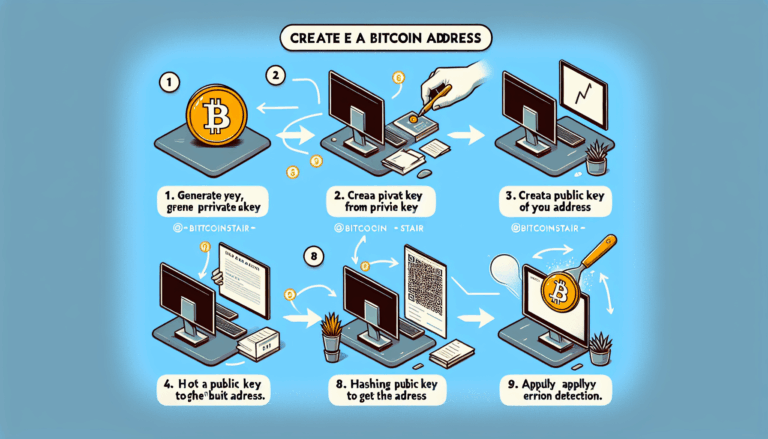

For enhanced security, consider using a Ledger Nano X, which can reduce the risk of private key leakage by up to 70%.

For more insights, check out our cross-chain security white paper and explore 2025’s DeFi regulatory trends in Singapore.

Ensure your assets are safe as you navigate through the complexities of the crypto world—stay informed with bitcoinstair.