2025 Cryptocurrency Market Depth HIBT Insights

2025 Cryptocurrency Market Depth HIBT Insights

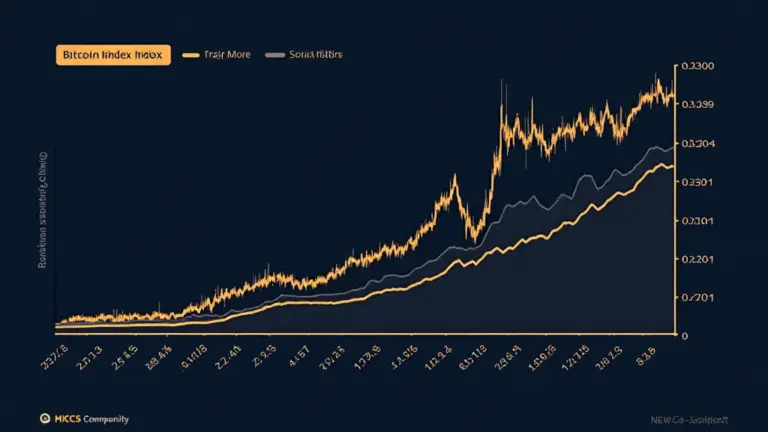

According to Chainalysis 2025 data, over 70% of cryptocurrency exchanges struggle with market depth, significantly impacting trade efficiency. This article dives into how the HIBT framework aims to enhance this critical aspect of the cryptocurrency market, ensuring a smoother trading experience for investors and developers alike.

Understanding Market Depth

Market depth refers to the market’s ability to sustain relatively large market orders without impacting the price of the stock or asset. Think of it as a busy farmers’ market where some stalls are loaded with fresh vegetables, while others barely have any produce at all. Just as a well-stocked stall can accommodate many buyers without raising prices, a deep market allows significant transactions without dramatic price shifts.

The Role of HIBT in Market Efficiency

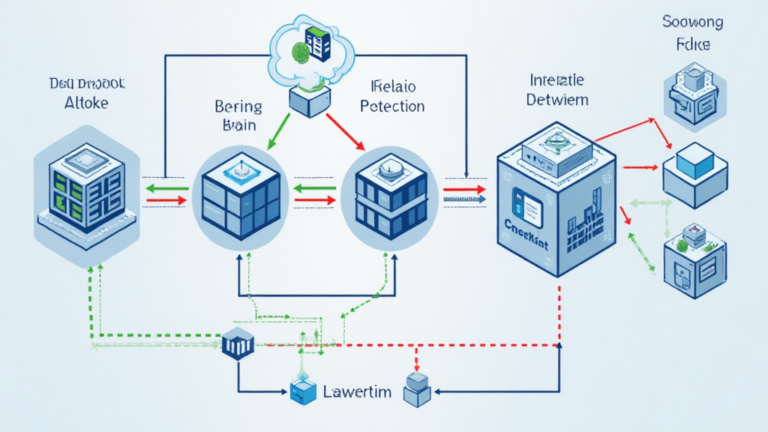

The HIBT (Hybrid Interoperable Blockchain Technology) framework enhances market depth by integrating decentralized liquidity pools across various platforms. Imagine a currency exchange that can trade euros for dollars, then to yen all in one go. HIBT achieves this through cross-chain interoperability, allowing traders to access a wider range of assets and liquidity options.

Zero-Knowledge Proof Applications in Cryptocurrency

Zero-knowledge proofs (ZKP) allow one party to prove to another they know a value without revealing the actual value. If you’ve ever played the