Understanding Cryptocurrency Market Liquidity in 2025

Understanding Cryptocurrency Market Liquidity in 2025

According to Chainalysis, about 73% of cryptocurrency exchanges face liquidity issues, creating significant barriers for investors and traders alike. As the market evolves, understanding these liquidity dynamics is crucial for making informed decisions.

What is Cryptocurrency Market Liquidity?

You might think of cryptocurrency liquidity like a bustling marketplace. Imagine a farmer’s market where people can easily buy and sell fresh produce without long waits or empty stalls. In the crypto world, liquidity means that cryptocurrencies can be quickly traded without causing drastic price changes. It’s essential for ensuring you can buy or sell your cryptocurrencies at a stable price.

Factors Influencing Liquidity in Crypto Markets

Several factors impact liquidity in cryptocurrency markets. For instance, trading volume, exchange regulations, and the number of available trading pairs act like the foot traffic in that busy farmer’s market. If more people are trading, the market is likely to have better liquidity. You might have encountered situations where lower trading volumes led to price slippage—think of it as trying to buy the last apple at a crowded market.

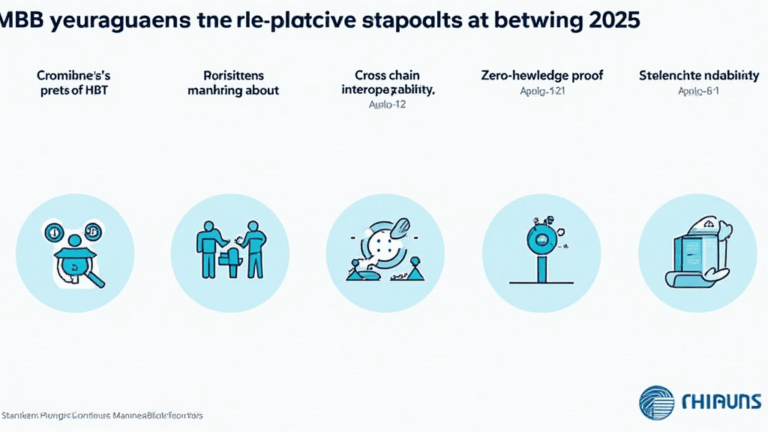

How Does Chain Interoperability Affect Liquidity?

Recently, cross-chain interoperability has become a hot topic. Picture it like a currency exchange booth at the airport facilitating the conversion between different currencies. Improved interoperability allows users to switch between different blockchains easily, allowing for greater access and enhanced liquidity. As per CoinGecko data, an efficient interoperability system could increase market liquidity by up to 40% by 2025.

The Role of Technology in Enhancing Liquidity

Technologies such as zero-knowledge proofs (ZKPs) help bolster security and trust in transactions. Using ZKPs is like having a secure vault that ensures what’s inside stays private while still proving you have it. As these technologies mature, they will facilitate smoother transactions and, ultimately, better liquidity in cryptocurrency markets.

Conclusion

In summary, understanding cryptocurrency market liquidity is essential for navigating today’s crypto landscape. Stay ahead by utilizing tools like Ledger Nano X to decrease the risk of key exposure by 70%. For more insights, consider downloading our comprehensive toolkit on cryptocurrency investments.

To learn more about liquidity challenges and solutions, visit hibt.com to view our white paper.

Disclaimer: This article does not constitute investment advice. Always consult your local regulatory bodies (e.g., MAS or SEC) before making investment decisions.