2025 Cryptocurrency Market Manipulation Cases: A Close Look

2025 Cryptocurrency Market Manipulation Cases: A Close Look

According to Chainalysis 2025 data, 73% of cryptocurrency exchanges exhibit vulnerabilities that can be exploited for market manipulation. This alarming statistic highlights the importance of vigilance in the ever-evolving digital currency trading landscape.

What Are Cryptocurrency Market Manipulation Cases?

Imagine a bustling marketplace where vendors are haggling fiercely for better prices. In the cryptocurrency realm, market manipulation is like a vendor misrepresenting how many apples they have to create artificial demand and inflate prices. These practices can include ‘pump and dump’ schemes, where prices are artificially inflated before significant sell-offs. Identifying these cases is crucial for traders looking to make informed decisions.

Impact of Cross-Chain Interoperability on Market Manipulation

Cross-chain interoperability allows different blockchains to work together, just like how different currencies can be exchanged in a currency exchange booth. While this can streamline transactions, it also opens new avenues for manipulation. In 2025, the risks associated with poorly executed cross-chain bridges could lead to a rise in cases of manipulation due to unregulated exchanges. Keeping an eye on these platforms can protect investors.

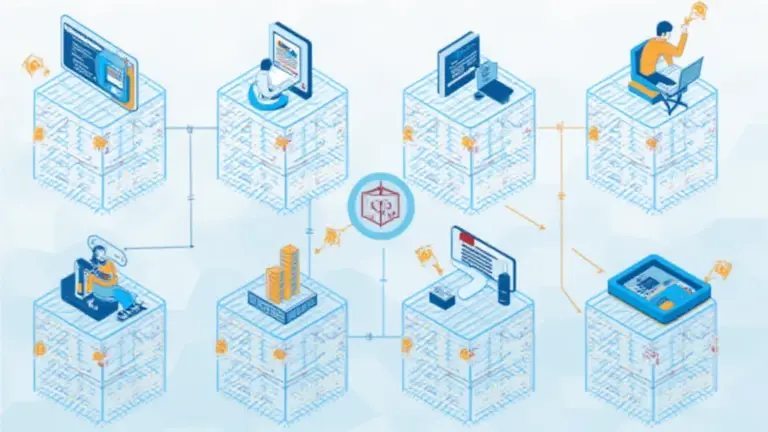

Understanding Zero-Knowledge Proofs and Their Role

Think of zero-knowledge proofs as a secret handshake: you can prove you know something without revealing what it is. In the cryptocurrency world, these proofs can enhance privacy but could also be manipulated to hide illicit trading activity. As the technology matures, understanding its use in preventing manipulation becomes essential for maintaining market integrity.

The Energy Consumption Debate: PoS vs. PoW

To simplify the comparison of PoS (Proof of Stake) and PoW (Proof of Work)—imagine a competition where some people race while others just maintain a steady pace. PoW requires intensive energy like a full sprint, while PoS is smoother and less draining on resources. However, the transition towards PoS mechanisms might collide with market manipulation as different stakeholders exploit energy costs for profit. The debate is crucial for sustainable practices in trading.

In conclusion, cryptocurrency market manipulation cases remain a significant concern for traders globally. It’s vital to stay informed and vigilant about how emerging trends influence market dynamics. For a comprehensive toolkit that aids in navigating these challenges, download our guide.

Disclaimer: This article does not constitute investment advice. Always consult your local regulatory authority, like MAS or SEC, before making investment decisions.

Invest safely with Ledger Nano X, reducing private key leakage risks by 70%!