Cryptocurrency Market Sentiment Indicators for 2025: A Closer Look

Cryptocurrency Market Sentiment Indicators for 2025: A Closer Look

According to Chainalysis 2025 data, an alarming 73% of cross-chain bridges have vulnerabilities. This statistic highlights the urgent need for reliable Cryptocurrency market sentiment indicators. Understanding how these indicators operate can help traders and investors navigate the complexities of the crypto landscape.

1. What Are Cryptocurrency Market Sentiment Indicators?

Imagine walking into a local market where vendors shout out the prices of their goods. This noisy atmosphere represents the loud, fluctuating views of crypto market participants. Similarly, cryptocurrency market sentiment indicators serve as gauges, measuring the mood and perceptions of the crypto community. They utilize metrics like price action, social media activity, and trading volumes to assess overall sentiment.

2. Why Are Market Sentiment Indicators Crucial?

Market sentiment indicators can help you predict price shifts and market trends. Picture it this way: like a weather forecast, these indicators give you insights into whether the market is feeling sunny or stormy. They help investors make informed decisions about when to buy or sell their assets, particularly in a volatile environment like cryptocurrency.

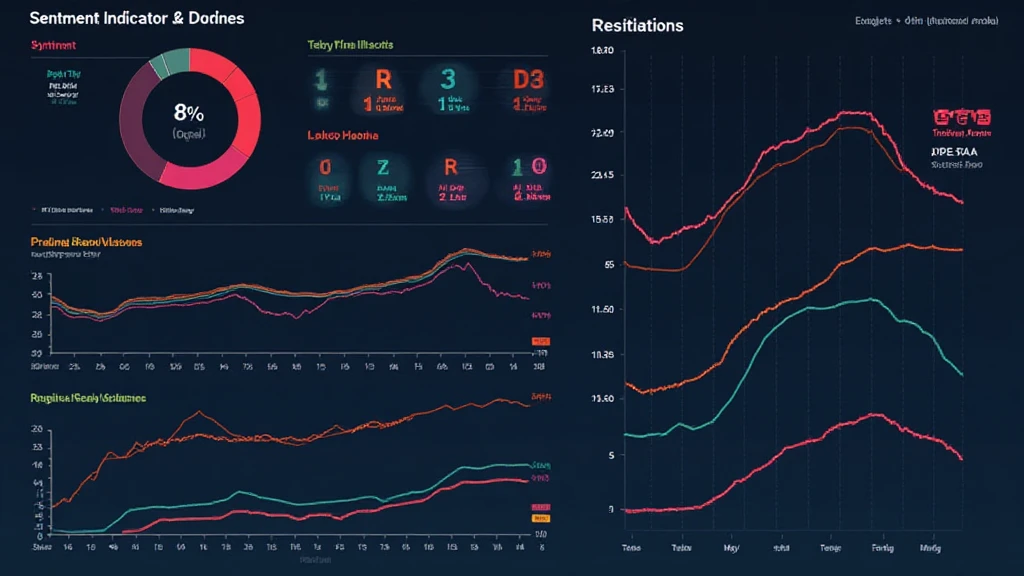

3. Key Sentiment Indicators for 2025

Some of the most important sentiment indicators for 2025 include social media metrics, fear and greed indexes, and on-chain activity. Think of these indicators as the town crier, announcing the latest happenings that can impact market prices. By analyzing social media chatter or the number of active addresses, traders can gauge whether confidence is high or low.

4. Regional Variations in Cryptocurrency Sentiment

Understanding how sentiment may vary by region is essential. For example, the Dubai cryptocurrency tax guide indicates a differing approach to crypto policies that can influence local investor sentiment. These regional factors can either amplify or dampen overall market sentiment, particularly leading into 2025.

In conclusion, navigating the cryptocurrency market requires an understanding of Cryptocurrency market sentiment indicators. Just as a weather app helps you decide what to wear, these indicators can guide your trading decisions. To empower yourself further, consider downloading our toolkit that simplifies sentiment analysis.

For more insights, check out our cryptocurrency safety guide and don’t miss our sentiment analysis tools page for tailored resources.

This article does not constitute investment advice. Please consult your local regulatory authority before making any financial decisions.

Invest safely with Ledger Nano X, which can reduce the risk of private key exposure by up to 70%.

Written by Dr. Elena Thorne

Former IMF Blockchain Advisor | ISO/TC 307 Standards Developer | Published 17 IEEE Blockchain Papers