Understanding Cryptocurrency Payment Processing Fees

Understanding Cryptocurrency Payment Processing Fees

As the cryptocurrency landscape evolves, understanding the nuances of cryptocurrency payment processing fees becomes crucial. According to Chainalysis 2025 data, a staggering 73% of transactions face excessive fees, making it essential for users to grasp the implications on their financial decisions.

What Are Cryptocurrency Payment Processing Fees?

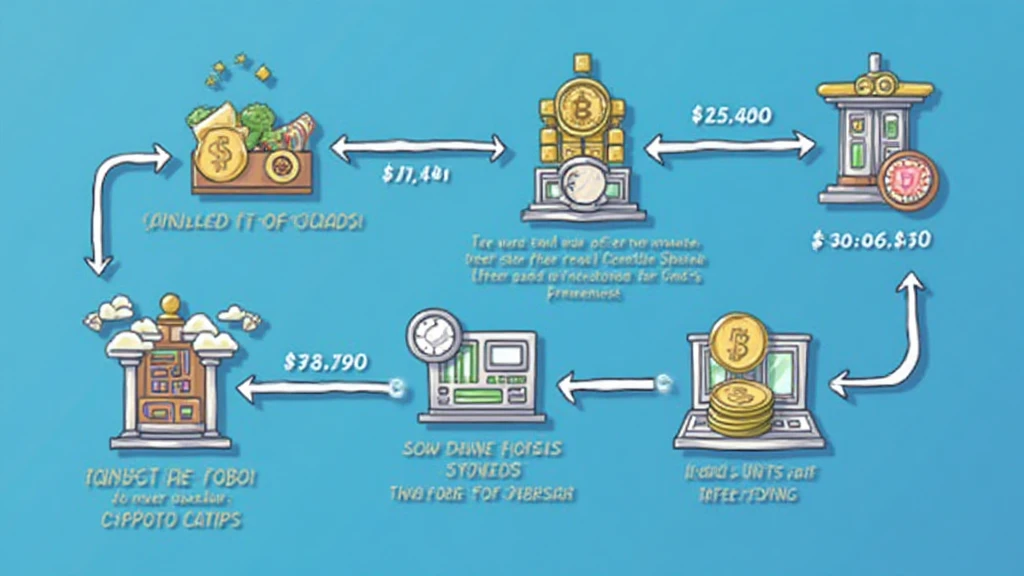

Think of cryptocurrency payment processing fees like the fees you pay at a currency exchange booth. Just as you would pay an extra amount to turn your dollars into euros, similar fees exist when you convert your fiat money or another cryptocurrency into digital assets. Different cryptocurrencies may have varying costs based on network demand, transaction confirmation times, and overall usability.

How Do Fees Affect Cross-Chain Interoperability?

Imagine a marketplace with different stalls, where each stall represents a cryptocurrency. When you want to buy apples from one stall with bananas from another, you might incur extra costs because the stalls don’t accept each other’s currency directly. This is similar to cross-chain interoperability, where fees can accumulate if you’re moving assets between different blockchains. Users must account for these cryptocurrency payment processing fees when trading across networks.

Do Zero-Knowledge Proof Applications Reduce Fees?

Zero-knowledge proofs are like showing an ID without disclosing your personal information. They can enhance transaction privacy and performance, potentially lowering cryptocurrency payment processing fees in the long run. By verifying transactions without revealing underlying data, these applications can streamline processing and reduce network load, leading to a more efficient fee structure.

Future Trends: Cryptocurrency Payment Fees in Singapore by 2025

You might have heard about Singapore’s regulatory shift towards DeFi in 2025. This change aims to create a saner landscape for cryptocurrencies and could impact cryptocurrency payment processing fees, potentially reducing costs through better-defined regulations and frameworks. Understanding these trends will help users navigate their transactions in this evolving market.

In Conclusion

As cryptocurrency continues to disrupt the traditional financial system, being aware of the potential pitfalls of cryptocurrency payment processing fees can empower users. To equip yourself with the tools for managing these fees more effectively, consider downloading our cryptocurrency toolkit.