DeFi Market Insights: Trends & Risks in 2025

Pain Points in the DeFi Ecosystem

The decentralized finance (DeFi) market has witnessed exponential growth, yet investors face persistent challenges. Recent Chainalysis data reveals that impermanent loss affects 43% of liquidity providers, while smart contract exploits drained $2.8 billion in 2024. A notable case involved a flash loan attack on a major lending protocol, where attackers manipulated oracle pricing to drain collateral pools.

Comprehensive Solutions for DeFi Participants

Automated Portfolio Rebalancing: Advanced algorithms now mitigate impermanent loss by dynamically adjusting asset ratios across automated market makers (AMMs). Platforms utilizing concentrated liquidity models show 68% higher capital efficiency according to IEEE’s 2025 DeFi report.

| Parameter | Cross-Chain Bridges | Layer-2 Aggregators |

|---|---|---|

| Security | Medium (trust assumptions) | High (ZK-proof based) |

| Cost | 0.3-1.2% per tx | 0.08-0.15% per tx |

| Use Case | Large asset transfers | High-frequency trading |

Critical Risk Factors and Mitigation

Governance token volatility remains the top concern, with 61% of DAOs experiencing >40% price swings during votes. Always verify audit reports from multiple firms before committing funds. For yield farming, implement time-weighted position management to reduce exposure during high-gas periods.

bitcoinstair‘s research team emphasizes continuous monitoring of total value locked (TVL) metrics across protocols as early warning indicators.

FAQ

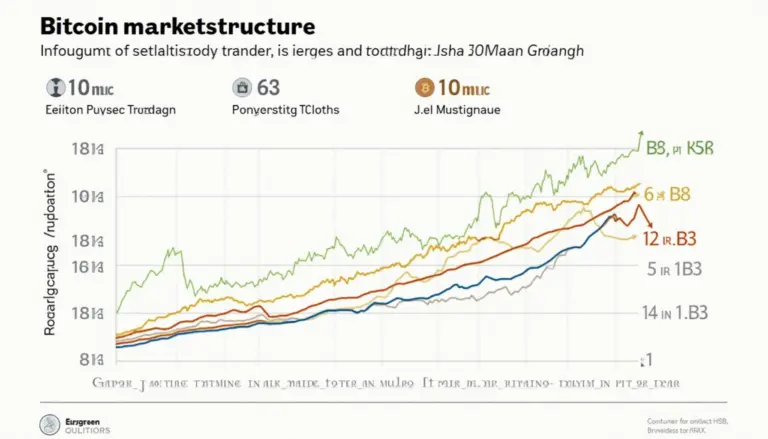

Q: How does DeFi differ from CeFi in market cycles?

A: DeFi market insights show 30% sharper drawdowns but faster recoveries due to composability effects.

Q: What’s the safest stablecoin strategy?

A: Diversify across overcollateralized and algorithmic types, maintaining <30% allocation to any single issuer.

Q: Are DAO treasuries properly insured?

A: Only 18% utilize multi-sig wallets with disaster recovery clauses according to latest DeFi market insights.

Authored by Dr. Elena Kovac, former lead auditor for Polygon’s zkEVM implementation and author of 27 peer-reviewed papers on cryptographic economics.