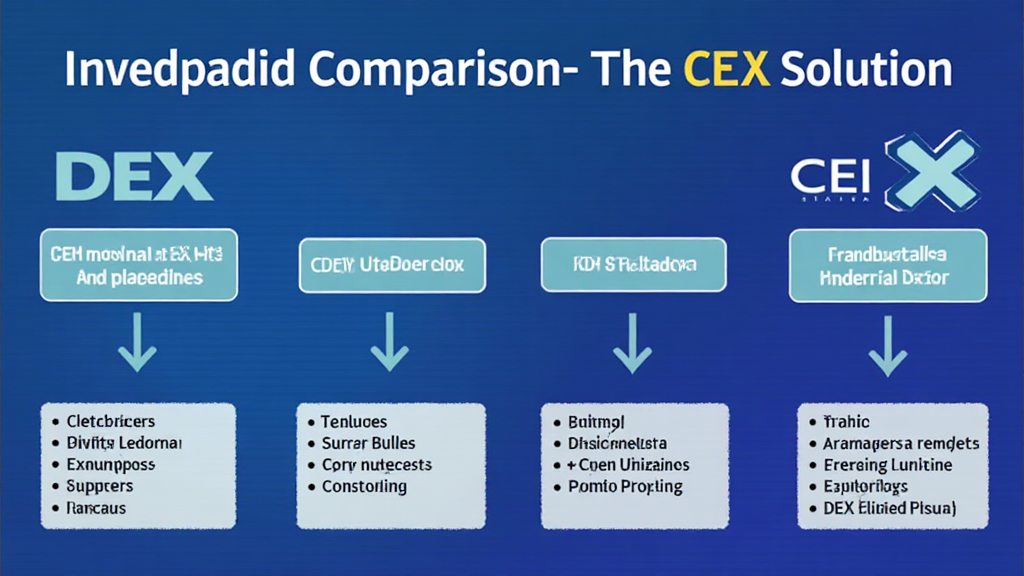

DEX vs CEX Trading: Understanding the Future of Cryptocurrency Exchanges

DEX vs CEX Trading: Understanding the Future of Cryptocurrency Exchanges

According to recent data from Chainalysis, a staggering 73% of cross-chain bridges present vulnerabilities, highlighting the urgent need for security in the realm of decentralized (DEX) and centralized exchanges (CEX). In this article, we will dive deep into the strengths and weaknesses of both trading environments, offering insights that could help you navigate the cryptocurrency landscape effectively.

What are DEX and CEX?

First things first, let’s break it down. Think of DEX like a farmer’s market where local suppliers bring their goods directly to you, while CEX is like a big supermarket that manages everything for you. DEX allows for peer-to-peer trading without middlemen, offering more control and privacy. On the other hand, CEX provides a user-friendly interface, making it easier for newcomers.

2025 DeFi Regulation Trends in Singapore

As we approach 2025, Singapore’s regulatory landscape for decentralized finance (DeFi) is evolving. You’ve probably heard about new regulations aiming at consumer protection and promoting innovation. It’s like adding safety nets at the farmer’s market while ensuring the products are still fresh and local, striking a balance between regulation and freedom.

Energy Efficiency: PoS Mechanism vs. PoW

One of the biggest debates in the crypto world revolves around the energy consumption of different consensus mechanisms. For instance, the Proof of Stake (PoS) model is like a bicycle – energy-efficient and sustainable, while Proof of Work (PoW) resembles a gas-guzzling SUV. As more platforms transition to PoS, we can expect a significant reduction in overall energy usage, making it a greener choice for 2025.

The Importance of Cross-Chain Interoperability

Cross-chain interoperability is crucial for the future of crypto trading. Imagine a large city where each neighborhood is connected by efficient public transport, allowing you to travel between them effortlessly. Without it, you’d be stuck walking everywhere. In crypto, cross-chain technology allows for seamless transactions across different blockchains, enhancing user experience and expanding market access.

In conclusion, understanding the dynamic between DEX vs CEX trading is essential for anyone engaging in cryptocurrency today. As technology and regulations continue to evolve, keeping up with these changes will empower you to make better trading decisions.

For in-depth resources, download our toolkit to enhance your trading knowledge and strategy. Don’t forget to visit hibt.com for more comprehensive information on security and trading practices.

Risk Disclaimer: This article does not constitute investment advice. Consult with your local regulatory authority such as MAS or SEC before making financial decisions.

Stay safe and trade wisely!