Exploring HIBT Compounding Returns Explained

Understanding HIBT Compounding Returns

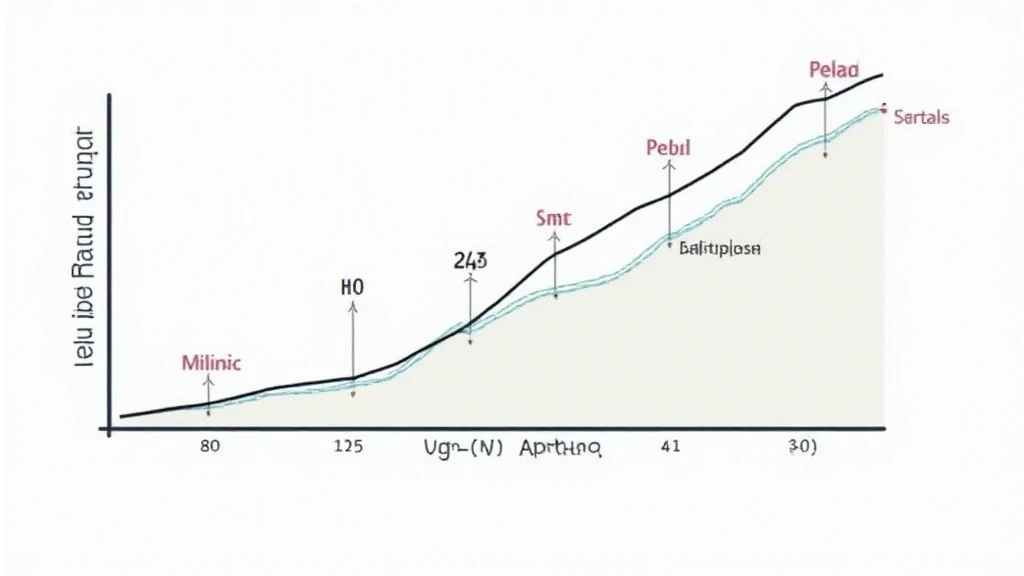

Have you ever wondered how to maximize your cryptocurrency investments? With HIBT’s innovative compounding returns feature, you can increase your profits exponentially. Compounding returns refer to the process where your earnings create additional earnings over time. For instance, if you invest $1,000 with a 10% return, you earn $100 in the first year. The following year, you earn $110 on your new total of $1,100.

Why Compounding Matters in Crypto

Just like with savings accounts in banks, compounding allows your investments to grow more quickly. With the volatile nature of cryptocurrencies, understanding the power of compounding can make a significant difference.

Real-World Application of HIBT

Suppose you invest in HIBT with a plan to hold for the long term. If you reinvest your earnings, your initial investment can grow substantially. Let’s say in year one, you have invested $1,000. After one year, at a 15% annual compounding rate, you’ll have $1,150. If you continue to reinvest, by year five, you’ll have approximately $2,011, doubling your initial investment.

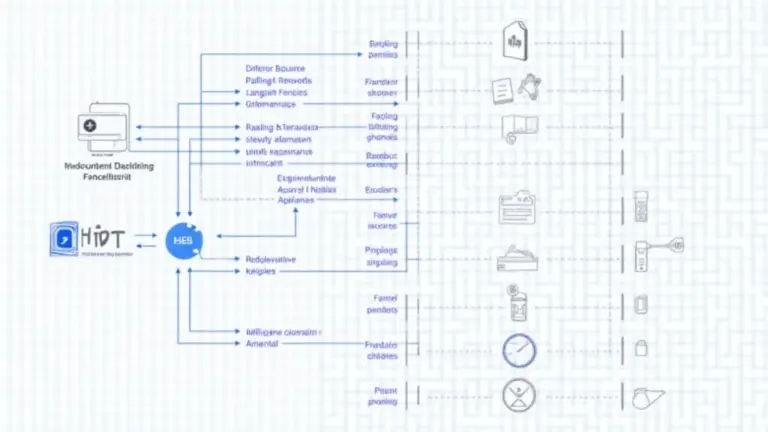

Key Factors Affecting Compounding Returns

- Investment Time Frame: The longer you leave your money invested, the greater the effect of compounding.

- Rate of Return: Higher returns lead to faster growth of your investment.

- Frequency of Compounding: The more often your returns are compounded (e.g., daily vs. annually), the more you earn.

Compounding in the Context of Vietnam’s Crypto Market

In Vietnam, the crypto market has seen a significant growth rate of over 150% in user engagement during the past year. As more Vietnamese adopt digital currencies, understanding how compounding works with HIBT can empower them to make smarter decisions.

Download our security checklist to enhance your crypto investment strategy.

Conclusion

As we explored, HIBT compounding returns can be a powerful tool to boost your investments. By leveraging the principles of compounding, Vietnamese crypto enthusiasts can capitalize on their investments and adapt to the rapid changes in the market. Remember, every investment carries risks; consult local regulators for guidance.