Comparing HIBT Crypto Exchange Fees

Comparing HIBT Crypto Exchange Fees

In the ever-evolving world of cryptocurrency, understanding the costs associated with different exchanges is crucial. With the explosive growth of crypto trading in Vietnam, where user adoption has surged by over 35% in the last year, comparing HIBT crypto exchange fees can help traders maximize their investments.

Why Fees Matter in Crypto Trading

Just like any trading platform, cryptocurrency exchanges impose fees that can eat into your profits. Picture it as a bank charging you for every transaction. If you’re unaware of these costs, you might not realize how much they impact your returns on investment. Here’s the catch: with fees varying widely between platforms, it pays to understand your options.

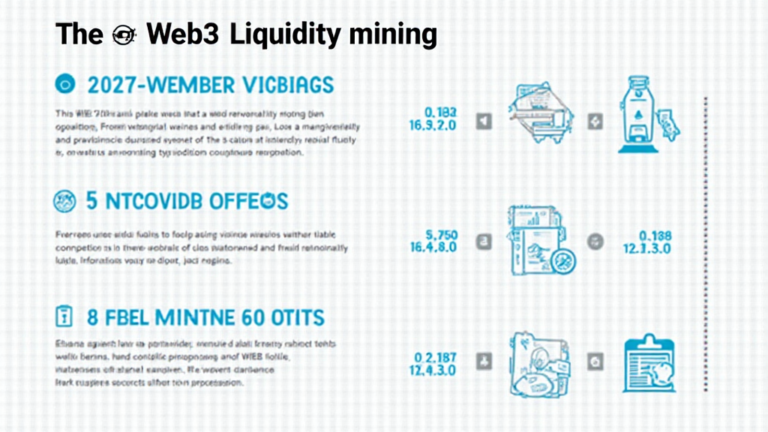

Types of Fees on HIBT

- Trading Fees: Typically charged as a percentage of the transaction volume. HIBT offers competitive trading fees compared to others.

- Withdrawal Fees: Fees incurred when withdrawing funds from your account to your wallet.

- Deposit Fees: Some exchanges charge for funding your account; however, HIBT may provide special promotions.

Breakdown of HIBT Fees

| Fee Type | HIBT Fees (%) | Industry Avg. (%) |

|---|---|---|

| Trading Fee | 0.20 | 0.25 |

| Withdrawal Fee | $1.00 | $2.00 |

| Deposit Fee | 0.00 | 0.02 |

As per recent data, HIBT’s trading fees are lower than the average, which can considerably enhance your profits.

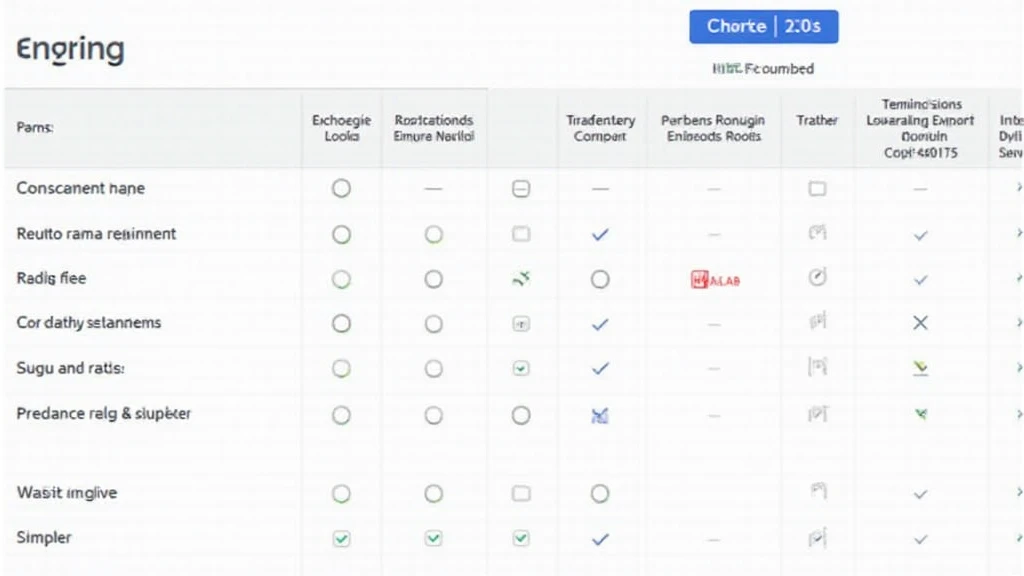

Comparing Alternatives: HIBT vs. Other Platforms

Let’s break it down further. Other popular exchanges often offer lower trading fees but might impose hefty withdrawal or deposit fees. In contrast, HIBT maintains a balanced fee structure that can benefit long-term traders and frequent transactions.

Vietnam Market Insights

In the Vietnamese market, the crypto scene is flourishing. In 2023 alone, Vietnam’s crypto user age demographic shows that 60% of crypto traders are aged between 25 and 34. This demographic is highly sensitive to transaction costs, making the HIBT crypto exchange fees comparison all the more relevant.

Real-World Application of Fee Comparisons

To illustrate the impact of trading fees, if you spend $1,000 on crypto with HIBT at a 0.20% fee, you’ll pay only $2.00. In comparison, on an exchange with a 0.30% fee, you’d part with $3.00. So, when trading is frequent, every dollar counts.

Tools like the fee calculator on HIBT can provide personalized insights tailored to your trading habits.

Conclusion

Understanding the HIBT crypto exchange fees comparison empowers traders to make informed decisions, maximizing their trading efficiency in a rapidly growing market. Engage with your investments wisely!

For more insights on crypto exchanges, check out our crypto strategies and guides.