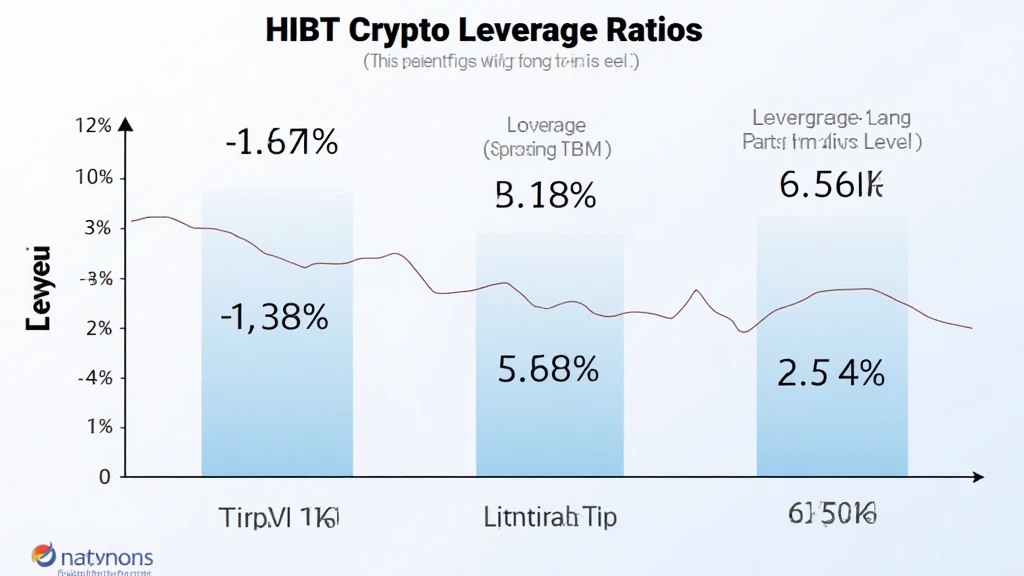

Understanding HIBT Crypto Leverage Ratios

Introduction

In the rapidly evolving world of cryptocurrencies, understanding the dynamics of HIBT crypto leverage ratios is paramount. Did you know that more than $4.1 billion was lost in DeFi hacks in 2024? This statistic highlights not only the vulnerabilities in trading but also the importance of having a solid grip on leverage ratios when navigating the crypto landscape.

By delving into how leverage works within HIBT platforms, traders can better position themselves for success and mitigate risks. This article provides valuable insights into leverage ratios, essential for both novice and seasoned investors.

What Are Leverage Ratios?

Leverage ratios indicate the extent to which a trader can use borrowed capital to increase their potential returns. Essentially, leveraging allows individuals to control a more substantial position with a smaller amount of their capital. The following are the critical components:

- Definition: A leverage ratio of 10:1 means that for every $1 of equity, a trader can control $10 in assets.

- Operational Use: Similar to how banks utilize leverage for lending, crypto platforms allow traders to amplify their positions.

How HIBT Leverage Ratios Work

HIBT crypto leverage ratios operate on a basis that weights risk and reward. Consider this analogy: like a bank vault that protects your currency, understanding leverage ratios ensures you manage risk effectively.

Examples of HIBT Leverage Ratios

Here’s a breakdown of potential ratios:

- 2:1 Leverage: Lower risk; suitable for cautious traders.

- 5:1 Leverage: Moderate risk; used by those with some experience.

- 10:1 Leverage: Higher risk; generally advised for experienced users.

The Benefits and Risks of Leverage in Trading

Leverage can enhance trading strategies but comes with its pitfalls. Here’s a closer look at both sides:

- Benefits: Potential high returns, increased market exposure.

- Risks: Higher losses, potential liquidation if margins are not maintained.

Vietnam’s Growing Crypto Market

The Vietnamese crypto market has seen significant growth, with a user increase rate of over 150% in the past year. This expansion indicates a rising interest in platforms like HIBT, particularly in leveraging opportunities. As a response to Vietnam’s increasing awareness, services tailored to local traders are vital.

Adapting Strategies to Local Markets

Incorporating local nuances like tiêu chuẩn an ninh blockchain can help enhance traders’ understanding of leverage ratios in the Vietnamese context.

Conclusion

Grasping the significance of HIBT crypto leverage ratios is essential for anyone looking to maximize their investment potential in cryptocurrencies. By knowing how to leverage appropriately and being aware of the associated risks, traders can make informed decisions, ultimately leading to greater success in their trading journeys. For ongoing updates and security insights, visit HIBT.