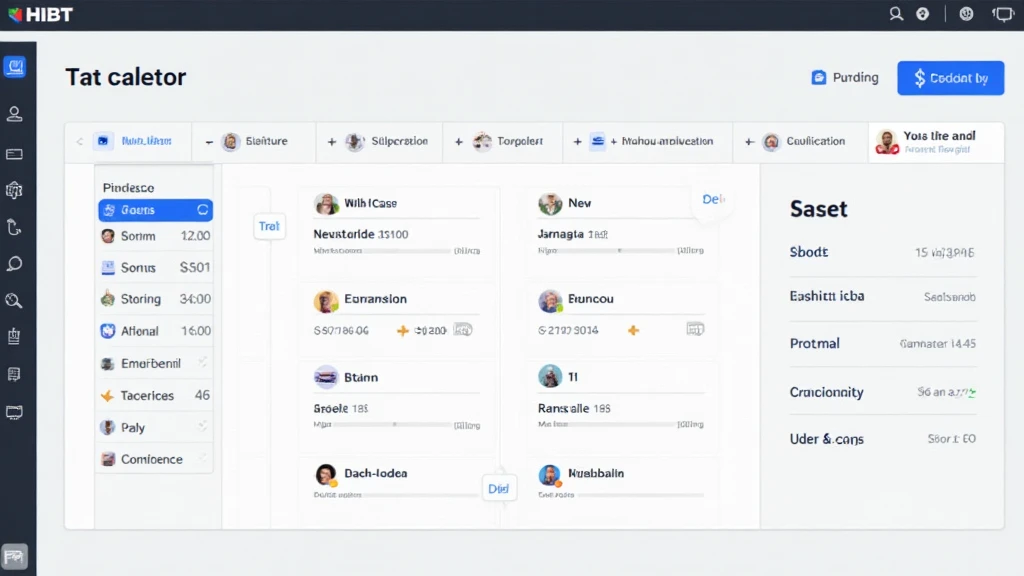

Calculate Your Crypto Taxes with HIBT

Calculate Your Crypto Taxes with HIBT

In 2024, the global cryptocurrency market witnessed an astonishing $4.1 billion lost due to hacks and security breaches, highlighting the importance of securing your digital assets and understanding your obligations. This is where the HIBT crypto tax calculator comes into play, simplifying the often complex tax filing process for cryptocurrency transactions.

The Importance of Using a Crypto Tax Calculator

As cryptocurrency gains traction in Vietnam and beyond, it’s crucial for investors to understand tax obligations. The HIBT crypto tax calculator aids in calculating gains and losses accurately, ensuring compliance with local regulations.

Real-World Application: Scenario Breakdown

- Example: You bought 1 Bitcoin for $30,000 and sold it for $40,000. Your gain? $10,000.

- With the HIBT tool, just input these figures and—boom!—you have an accurate tax figure ready for filing.

Features of HIBT Crypto Tax Calculator

- User-Friendly Interface: The calculator is designed for both novice and experienced investors.

- Local Compliance: It offers features tailored to the Vietnamese market, acknowledging the rapid growth in user adoption.

- Accuracy: Minimizing human error ensures reliable calculations.

Understanding Your Tax Obligations

Many users might wonder, “What do I need to report?” The HIBT crypto tax calculator will generate all necessary reports, but here’s a simplified breakdown:

- Gains from trading cryptocurrencies

- Income generated from staking

- Losses that can offset your gains

Why Choose HIBT?

Here’s the catch—many tax calculators fail to account for local laws. HIBT updates its algorithms based on the latest regulations, ensuring reliability. In Vietnam, where growth rates in the crypto sector have surged, understanding these nuances is vital.

According to Vietnam’s Ministry of Finance, over 30% of Vietnamese citizens are now involved in cryptocurrency trading, making tools like HIBT invaluable.

Practical Tips for Filing Taxes

- Keep Detailed Records: Always document every transaction.

- Consult Professionals: Not financial advice, but consider a consultant for complex situations.

- Use Accurate Tools: Employ the HIBT crypto tax calculator for the most effective management.

Conclusion

With crypto investments booming in Vietnam and globally, using the HIBT crypto tax calculator will undoubtedly help streamline your tax preparation process. Stay compliant and make your tax season less daunting by leveraging this powerful tool. Explore more at HIBT.com.

Stay informed, stay compliant, and maximize your crypto journey with bitcoinstair.

Author: Dr. Michael Nguyen

Dr. Nguyen has published over 15 papers on crypto regulation and compliance and led audits for high-profile blockchain projects.