Ensuring Compliance: HIBT Crypto Tax Strategies

Ensuring Compliance: HIBT Crypto Tax Strategies

As the digital asset market expands, understanding tax compliance becomes pivotal. In 2024, over $4.1 billion was lost due to DeFi hacks, highlighting the urgent need for secure practices. Enter HIBT crypto tax compliance—a solution designed for crypto investors to navigate the intricate world of digital asset taxation. This guide provides insights into essential compliance strategies tailored for the Vietnamese market.

The Growing Need for HIBT Crypto Tax Compliance

Vietnam has seen a rapid crypto adoption, with a reported growth rate of 300% in users from 2022 to 2023. With this growth, tax compliance is more crucial than ever. HIBT crypto tax compliance offers a framework that allows investors to stay ahead, ensuring they are not only protecting their assets but also meeting regulatory requirements.

Understanding Your Tax Obligations

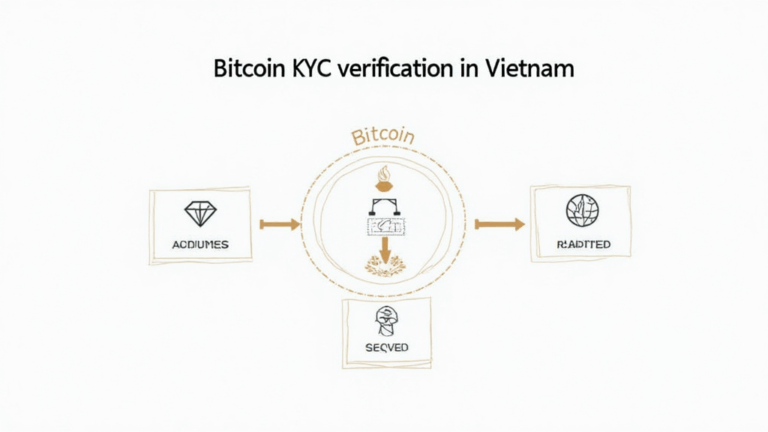

Let’s break it down. At its core, understanding crypto tax obligations involves knowing the ins and outs of your local regulations. In Vietnam, digital assets are deemed taxable, meaning any trade or sale could trigger capital gains taxes. HIBT provides clarity on how to manage these obligations effectively.

Key Elements of HIBT Compliance

- Tracking Transactions: Maintaining accurate records of all crypto activities is essential for compliance.

- Understanding Tax Brackets: Different brackets apply to various levels of gains, and HIBT clarifies these for you.

- Utilizing Tax Tools: Recommended tools like Ledger Nano X can enhance security and make tracking simpler.

Strategies for Successful Compliance

Here’s the catch: strategies for compliance are not one-size-fits-all. Employing HIBT crypto tax compliance means personalized strategies that resonate with your trading volumes and asset types. Frequent audits might also be necessary. Learn how to audit smart contracts to spot potential issues early, preventing compliance mistakes.

Real-Time Data Tracking

Embed tools into your trading strategy. Using platforms that integrate with HIBT can ensure your transactions are recorded in real-time, making it easier to manage and report your tax obligations. According to Chainalysis 2025, automated reporting tools are expected to ease the burden on crypto investors significantly.

Conclusion: Why HIBT Matters

Staying compliant with taxation in the crypto space is as vital as securing your assets. HIBT crypto tax compliance not only simplifies the process but ensures trust and accuracy, particularly in a vibrant market like Vietnam. As we navigate through 2025, the compliance landscape will evolve, and staying informed with HIBT strategies will allow your investments to thrive.

To learn more about maintaining compliance and protecting your investments, visit hibt.com for resources and tools tailored to your needs.

Author: Dr. Michael Tran – A recognized expert in blockchain compliance, having published over 15 papers on crypto regulations and audited multiple high-profile projects in Southeast Asia.