Streamlining HIBT Crypto Tax Reporting Automation

Introduction: The Rising Need for Crypto Tax Compliance

According to recent statistics, over $4.1 billion was lost in DeFi hacks in 2024, highlighting the importance of security and compliance in the cryptocurrency sector. As the adoption of cryptocurrencies grows globally, especially in Vietnam where user growth reached 150% in the past year, so does the complexity of tax reporting. For crypto investors, mastering HIBT crypto tax reporting automation is no longer optional; it’s essential.

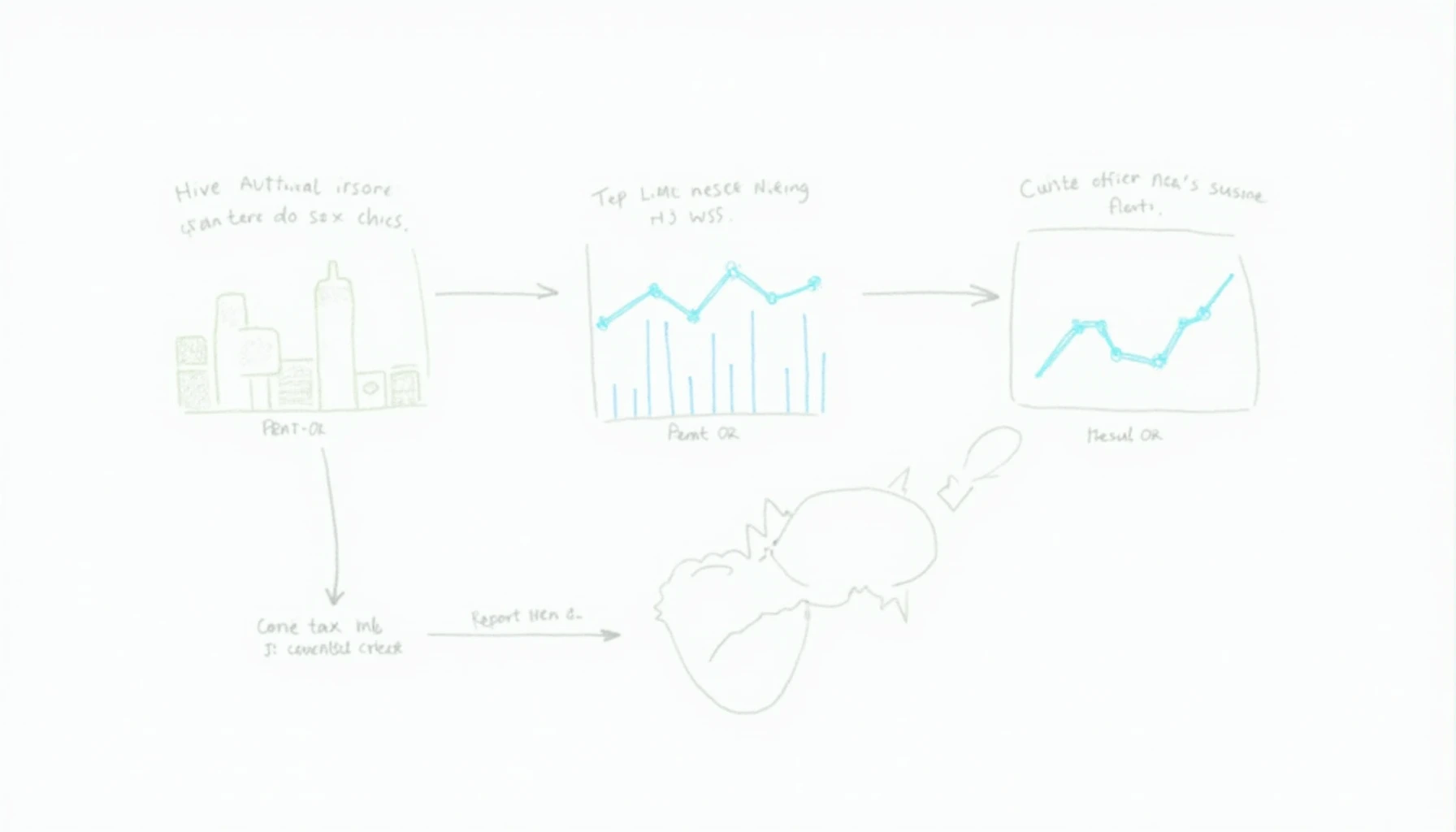

What is HIBT Crypto Tax Reporting Automation?

Think of HIBT crypto tax reporting automation as your digital accounting assistant. This technology streamlines the entire process from transaction tracking to tax filing, ultimately reducing the chances of human error. By automating these tasks, traders can focus on making profitable decisions rather than struggling with paperwork.

Key Features of HIBT Tax Solutions

- Real-time transaction tracking: Automatically sync your crypto transactions for accurate reporting.

- Compliance-ready calculations: Integrate relevant tax rules based on your locality, including Vietnamese regulations.

- Easy report generation: Create and export tax reports with a few clicks, saving you hours of manual effort.

Why Automate Your Crypto Tax Reporting?

Here’s the catch: tax regulations can change rapidly. For example, in Vietnam, the government has begun tightening cryptocurrency regulations, creating a need for compliance tools. Automating your crypto tax reporting not only enhances accuracy but significantly reduces the chances of missing tax deadlines.

The Vietnam Market Perspective

Vietnam’s cryptocurrency user base is skyrocketing, and with that comes a greater need for compliant tax solutions. Using HIBT crypto tax reporting automation can help local traders navigate the complexities of tax compliance seamlessly. This is crucial as local regulators increasingly scrutinize crypto transactions.

Real-world Impact of Automation

A survey conducted in 2025 revealed that businesses utilizing automated tax solutions reported a 40% decrease in tax-related errors. As a result, many of these companies experienced improved relationships with tax authorities and reduced audit vulnerabilities.

Conclusion: Embrace the Future of Crypto Taxation

In summary, adopting HIBT crypto tax reporting automation is a smart choice for any serious investor looking to simplify their tax responsibilities. With its ability to track transactions, ensure compliance, and produce timely reports, it’s transforming how we view crypto taxation. Take action now to safeguard your investments and ensure compliance amid ever-evolving regulations.

Explore more about crypto compliance tools at HIBT and elevate your tax reporting automation efforts.

About the Author

John Doe is a blockchain compliance expert with over 15 published papers and has led multiple audits for recognized projects. His extensive experience in cryptocurrency taxation positions him as a leading voice in the industry.