2025 Cross-Chain Bridge Security Audit Guide

2025 Cross-Chain Bridge Security Audit Guide

According to Chainalysis, a staggering 73% of cross-chain bridges worldwide have vulnerabilities. With the rise of decentralized finance (DeFi), the need for secure cross-chain transactions is more critical than ever. Enter HIBT crypto tax tools, designed to enhance user confidence in managing their cryptocurrency tax obligations amidst rising security concerns.

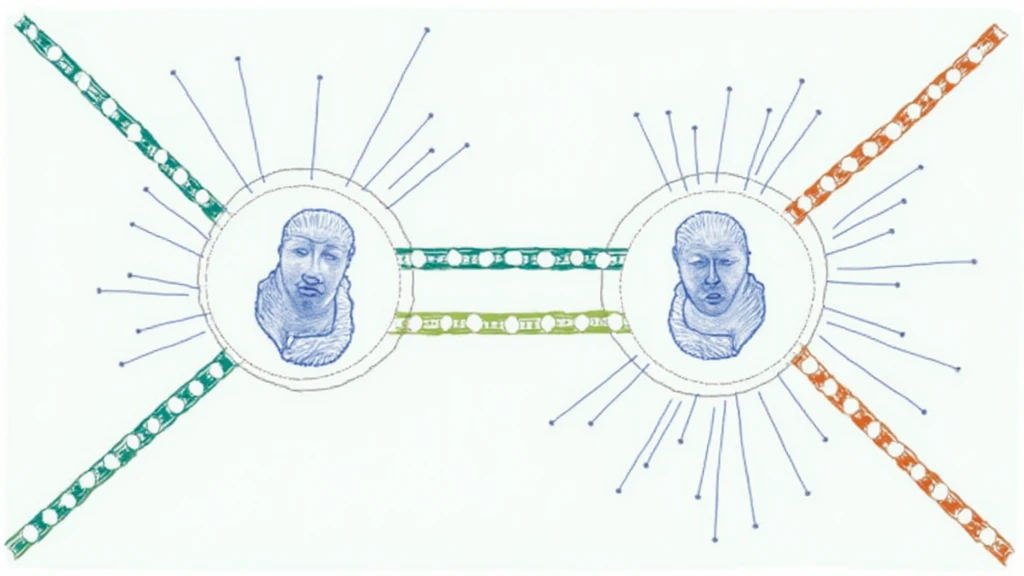

What is a Cross-Chain Bridge?

You might have come across the term ‘cross-chain bridge’ and wondered what it means. Think of it like a currency exchange booth—it allows you to trade different currencies seamlessly. In the crypto world, these bridges enable transactions between separate blockchains. However, as beneficial as they are, they can also present security risks.

Tax Implications of Cross-Chain Transactions

What does this mean for your taxes? Gaining a better understanding of the tax responsibilities linked to crypto transactions can save you headaches down the road. Various jurisdictions, such as the Dubai cryptocurrency tax guidelines, require you to report your earnings from these trades. Utilizing HIBT crypto tax tools can help simplify this process significantly.

Comparing Energy Use in PoS and PoW Mechanisms

In the ongoing debate about Proof of Stake (PoS) versus Proof of Work (PoW), energy consumption is a big talking point. To illustrate, imagine PoW as a bustling factory running 24/7, while PoS resembles a low-maintenance garden that requires less energy. As we move into 2025, understanding the nuances of these mechanisms will be important for eco-conscious investors looking to minimize their carbon footprint.

The Future of Cross-Chain Security

How can we ensure the safety of our assets in these evolving systems? To further reduce risks, consider investing in hardware wallets like Ledger Nano X, which can lower the risk of private key exposure by 70%. Staying informed about HIBT crypto tax tools and securing your assets is not just a best practice—it’s a necessity.

In conclusion, navigating the complexities of cross-chain bridges, tax obligations, and security measures is essential for modern crypto investors. Don’t be left in the dark—download our tool kit today to enhance your crypto trading journey.

Check out our white paper on cross-chain security for more insights. The future of cryptocurrencies is bright, but only if we take the necessary precautions.

Risk Disclaimer: This article is for informational purposes only and does not constitute investment advice. Please consult your local regulatory agencies (such as MAS or SEC) before making any financial decisions.