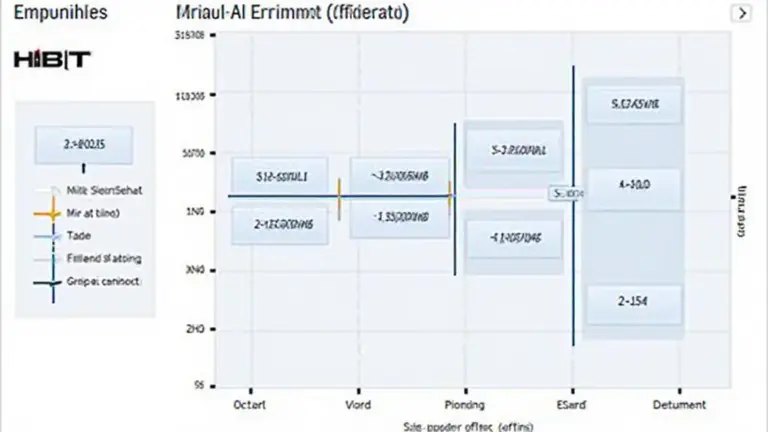

Comparing HIBT DEX Liquidity Provider Fee Structures

Understanding Liquidity Provider Fees in HIBT DEX

In the rapidly evolving world of decentralized finance (DeFi), liquidity is paramount. An alarming statistic reveals that with $4.1 billion lost to DeFi hacks in 2024, understanding the fee structure of liquidity providers is crucial for investors. This article delves into the liquidity provider fee structure comparisons in HIBT DEX, offering insights tailored for both new and experienced users.

The Importance of Fee Structures

When liquidity providers participate in HIBT DEX, they’re often concerned with the fee structures that govern their investments. Here’s why it matters:

- Returns on Investment: High fees can eat into profits.

- Market Competitiveness: Understanding fees can help choose the best platform.

- Sustainability: It impacts the viability of liquidity provisioning.

Fee Structures Overview

HIBT DEX adopts several models for liquidity provider fees, providing options for varying risk tolerances and investment strategies:

- Flat Fee Model: A constant fee irrespective of the transaction size, often simpler and better for low-volume traders.

- Variable Fee Model: Fees that adjust based on the transaction volume, rewarding high-frequency traders.

- Dynamic Fee Model: Fees vary depending on overall liquidity conditions and market volatility, keeping the system responsive to market needs.

Comparative Analysis of HIBT DEX Fees

To grasp how HIBT DEX competes with other platforms, let’s compare its fee structures:

| DEX Platform | Fee Type | Fee Rate |

|---|---|---|

| HIBT DEX | Variable | 0.1% – 0.3% |

| Other DEX 1 | Flat | 0.25% |

| Other DEX 2 | Dynamic | 0.2% – 0.5% |

According to industry data from 2025, the chosen fee type can make a significant impact on overall profitability.

Tips for Maximizing Your Earnings

Investors should consider the following tips when navigating fee structures in HIBT DEX:

- Assess the trading volume—higher volumes may benefit from variable or dynamic fees.

- Stay informed about market conditions and adjust liquidity provisioning strategies.

- Consider cross-chain liquidity to diversify and enhance returns.

Conclusion

In summary, dissecting the HIBT DEX liquidity provider fee structure comparisons enables investors to make educated decisions and optimize returns. As the DeFi landscape in Vietnam gains momentum, with a user growth rate of approximately 40% in 2025, it’s essential to stay ahead of the curve by understanding fee dynamics.

For further insights and resources, visit hibt.com.