Understanding HIBT Funding Rate: Your 2025 DeFi Guide

Understanding HIBT Funding Rate: Your 2025 DeFi Guide

According to Chainalysis 2025 data, 73% of DeFi platforms face significant risks linked to funding rates, impacting investor confidence and market stability.

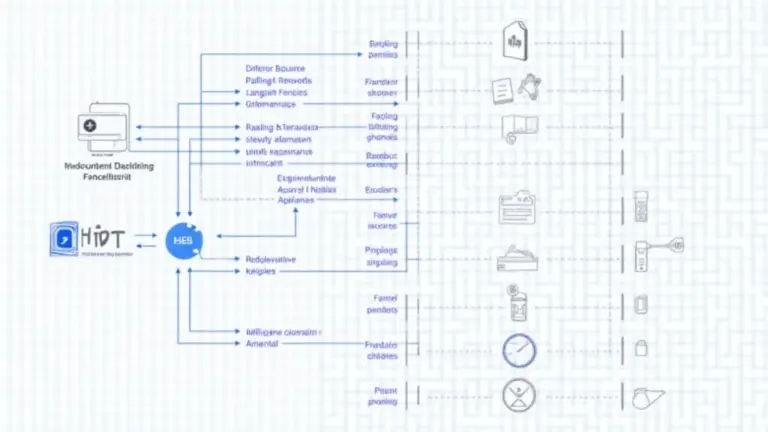

What is the HIBT Funding Rate?

So, let’s break it down: the HIBT funding rate is like the price of admission for a concert. If you want access to a fancy venue, you must pay a ticket price, which fluctuates based on demand. In trading, this rate tells traders how much they need to pay (or receive) to maintain their positions. When more traders are optimistic, the fees rise; when pessimism lingers, they drop.

How Does HIBT Affect Your Trades?

Imagine you are cooking in a busy kitchen; if everyone wants the chef’s special, the ingredients get pricier. In the trading world, the HIBT funding rate represents how much it costs to hold a position. Higher rates mean a more expensive holding cost. Thus, traders must weigh these costs against potential profits before making moves.

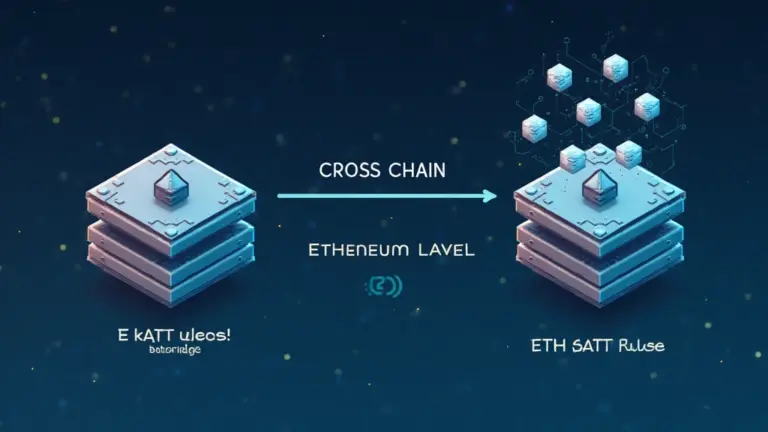

Future Innovations in HIBT Funding Rates

Did you know that decentralized finance (DeFi) is projected to grow rapidly? By 2025, adoption of innovations like zero-knowledge proofs will enable more transparent and secure transactions, affecting HIBT funding rates. Think of it as upgrading from a bicycle to a high-speed train; it makes your journey smoother and faster in the financial landscape.

Is HIBT Funding Rate Safe for Investors?

Safety in investment is paramount. You might have heard that using precautions like a Ledger Nano X can reduce the risk of key leakage by 70%. When considering HIBT funding rate fluctuations, always factor in market volatility and ensure your strategies are secure.

In summary, understanding the HIBT funding rate can empower you in the ever-evolving DeFi landscape. Stay informed, leverage tools to enhance your security, and navigate the financial waves with confidence!

For a deeper dive into funding rates, download our comprehensive toolkit at hibt.com.