Understanding HIBT Futures Margin Requirements

Introduction

In 2024 alone, the crypto markets saw an influx of new investors, with a staggering growth rate of 85% in Vietnam. With this surge, understanding HIBT futures margin requirements becomes increasingly important for traders looking to optimize their positions.

But what exactly are these margin requirements? Think of them like a safety net, ensuring that you have enough collateral in place to support your trading positions while minimizing the risk of liquidation. As more traders flock to platforms like HIBT, grasping these fundamentals can significantly impact their trading outcomes.

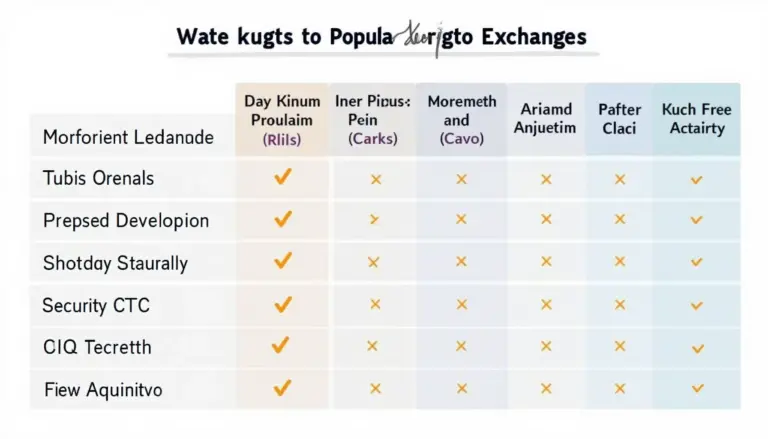

1. What are HIBT Futures Margin Requirements?

At its core, HIBT futures margin requirements refer to the minimum amount of capital a trader must maintain in their account to open and maintain a futures position. This requirement can fluctuate based on market volatility and the specific trading pair being utilized.

- Initial Margin: The amount needed to initiate a trade.

- Maintenance Margin: The minimum equity a trader must maintain to keep their position open.

2. Importance of Understanding Margin Requirements

Trade execution on futures markets can be akin to navigating a high-wire act—balance is key. If you’re unfamiliar with margin requirements, you might find yourself abruptly forced out of your positions due to unfavorable market moves. The stakes can be even higher with volatile assets.

3. Recent Trends in Vietnam’s Crypto Market

Vietnam’s increasing user base highlights the necessity of effective margin strategies. In 2025, analysts predict that engagement in crypto futures trading will rise by another 30%. Therefore, understanding HIBT futures margin requirements will be pivotal for both seasoned traders and newcomers looking to capitalize on this growth.

4. Practical Tips for Managing Margin Effectively

Your approach to margin management can be compared to a well-timed chess game. Making calculated moves can save your capital from potential losses. Here’s how to stay in the game:

- Regularly monitor your account balance and margin levels.

- Utilize stop-loss orders to minimize losses.

- Keep abreast of market conditions and adjust your strategy accordingly.

Conclusion

Ultimately, navigating HIBT futures margin requirements can significantly influence your trading success in the bustling world of cryptocurrency. As the market continues to evolve, ensuring that you understand these requirements is not just advisable—it’s essential. With the Vietnamese market growing rapidly, staying informed allows you to seize opportunities while managing risks effectively. For more insights, explore our resources on HIBT.

Additionally, if you’re looking for in-depth crypto strategies, check out our articles on Vietnam’s crypto tax updates and how to audit smart contracts.

With these tools at your disposal, you can aim for a more secure and successful trading experience.