HIBT Institutional Custody Solutions for Beginners

Understanding HIBT Institutional Custody Solutions

With global cryptocurrency thefts estimated to reach $3.8 billion in 2024, ensuring the safety of digital assets is paramount. HIBT institutional custody solutions are designed to provide a secure environment for investors looking to safeguard their cryptocurrencies. These solutions act like a bank vault for your digital assets, offering advanced protection against potential threats.

What is Institutional Custody?

Institutional custody refers to the service provided by financial institutions that securely hold and manage assets on behalf of clients. For those entering the crypto space, HIBT provides a beginner-friendly approach by utilizing top-tier security measures based on tiêu chuẩn an ninh blockchain, ensuring that your digital assets are well-protected.

Why Use HIBT Custody Solutions?

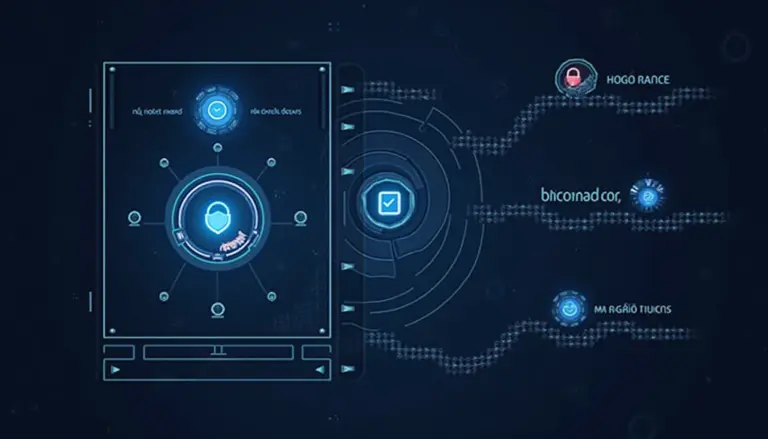

Here’s the catch: traditional wallets may not offer the robust security needed for substantial investments. HIBT’s solutions are designed with institutional investors in mind, boasting features such as multi-signature wallets and insurance coverage. For instance, according to data from Chainalysis, institutions that use custody solutions experience up to a 60% reduction in security breaches.

Key Features of HIBT Custody Solutions

- Multi-Signature Security: Requires multiple approvals for transactions, significantly reducing the risk of fraud.

- Insurance Coverage: HIBT offers insurance on digital assets, providing peace of mind for investors.

- Regulatory Compliance: Ensures adherence to local regulations, which is critical in markets like Vietnam, where user growth is rapidly expanding at a rate of 50% annually.

How to Get Started with HIBT Custody Solutions

Starting out is easier than you might think! You can sign up through the HIBT website, complete your verification, and start transferring into your secure custody account. Don’t forget to download our security checklist for best practices.

Conclusion

In conclusion, utilizing HIBT institutional custody solutions is an excellent way for beginners to ensure the security of their digital assets. With advanced features and a user-friendly platform, protecting your investments has never been simpler. For more guidance, refer to our Vietnam crypto tax guide to navigate the financial landscape with confidence.