HIBT Price Technical Analysis: Insights for 2025 DeFi Trends

HIBT Price Technical Analysis: Insights for 2025 DeFi Trends

According to Chainalysis data for 2025, a staggering 73% of cross-chain bridges show vulnerabilities that could affect the security of digital assets. This raises critical questions for investors seeking to enter the DeFi space.

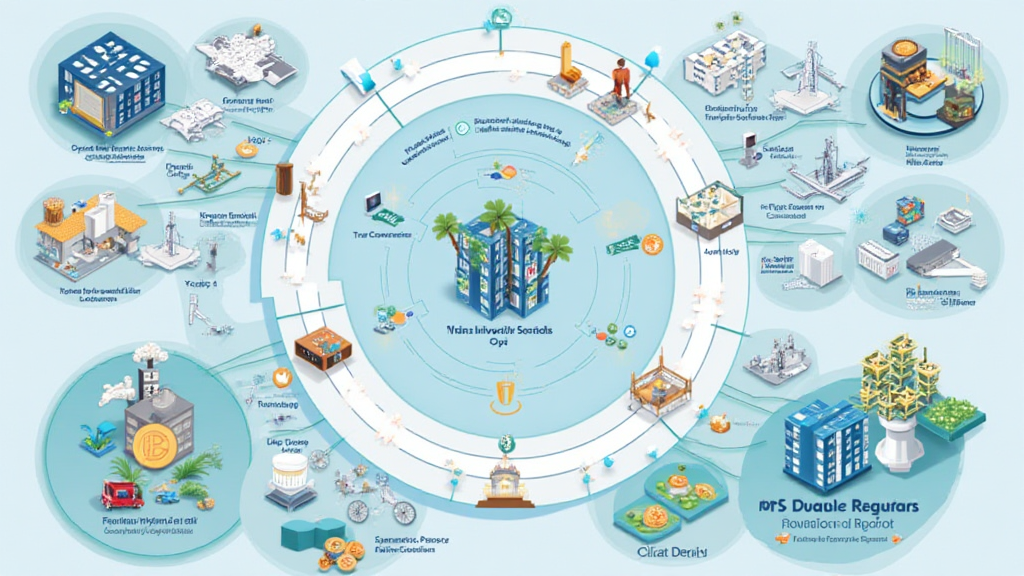

Understanding Cross-Chain Interoperability

Imagine you’re at a local currency exchange booth, where you can swap your dollars for euros. This process is much like cross-chain interoperability in blockchain, allowing different networks to communicate. However, as highlighted by CoinGecko data, while these exchanges may help you diversify your investments, not all bridges are secure. This forms a crucial aspect of HIBT price technical analysis.

The Application of Zero-Knowledge Proofs in Transactions

You might have heard of zero-knowledge proofs but didn’t understand their significance. Think of it like sharing a secret recipe; you can prove that you know the method without revealing the actual ingredients. This is becoming increasingly important in securing transactions, ultimately influencing the HIBT price.

Eco-Friendly Considerations: PoS Mechanism Efficiency

With the rise of sustainability concerns, the comparison between Proof of Stake (PoS) and traditional methods is vital. Picture a power plant running on clean energy versus one that’s polluting; PoS consumes less energy and is less harsh on the environment. Analyzing these factors contributes to a more comprehensive HIBT price technical analysis for eco-conscious investors.

Regional Regulations Impact on HIBT Investments

If you live in Dubai, understanding the local cryptocurrency tax guidelines is essential. It’s like being aware of traffic rules before diving into the road race; it helps you avoid pitfalls while navigating the complexities of digital investments. This local knowledge can greatly influence your perception of HIBT’s potential.

In conclusion, being aware of cross-chain vulnerabilities, the role of zero-knowledge proofs, PoS efficiencies, and understanding local regulations can provide a clear path for navigating HIBT price technical analysis. For a deeper dive, download our toolkit and arm yourself with the knowledge needed for successful investment.

Download our exclusive investment toolkit.

Risk Disclosure: This article does not constitute investment advice. Always consult local regulatory authorities before making decisions, such as MAS or SEC.

Using tools like Ledger Nano X can significantly reduce the risk of private key compromises by up to 70%.