HIBT Response to EU MiCA Regulations: A Guide to Compliance

HIBT Response to EU MiCA Regulations: A Guide to Compliance

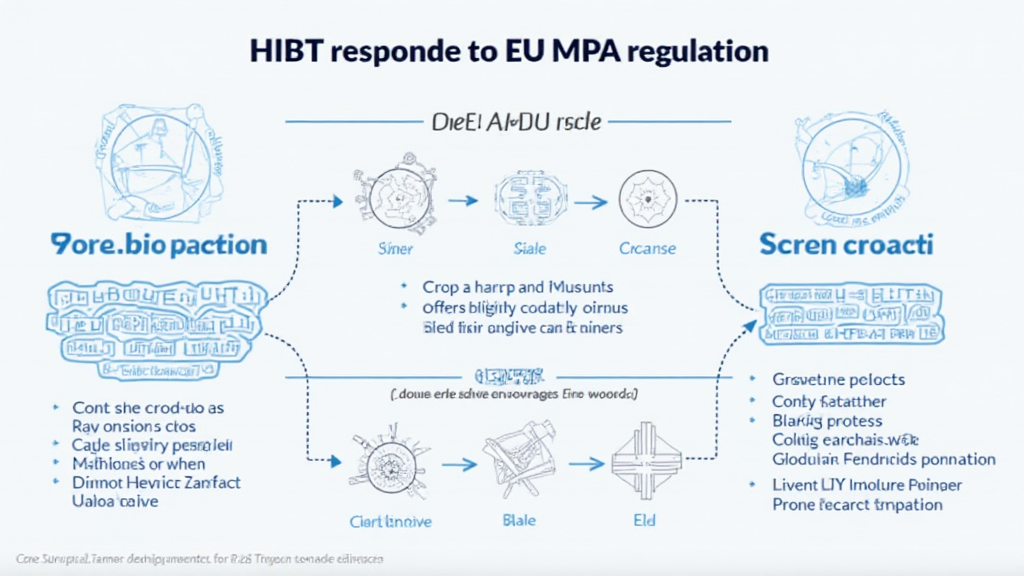

According to Chainalysis data from 2025, a staggering 73% of cross-chain bridges exhibit vulnerabilities, raising significant concerns for regulatory compliance in the evolving digital currency landscape. As the EU moves closer to implementing MiCA (Markets in Crypto-Assets) regulations, the cryptocurrency community is eager to understand how these changes will impact the industry, particularly in relation to interoperability and the application of zero-knowledge proofs.

Understanding EU MiCA Regulations

So, what exactly are the EU MiCA regulations? Think of them as a set of rules intended to provide structure and safety in the often-chaotic world of cryptocurrencies. Just like road traffic rules keep drivers safe, MiCA aims to protect investors and create a more stable environment for digital assets.

Cross-Chain Interoperability Challenges

Cross-chain interoperability can seem complex, but you can think of it like a currency exchange booth at an airport. Not every currency can be directly swapped; similar challenges arise in the crypto world. HIBT’s response to these challenges focuses on creating systems that facilitate seamless transactions across various networks, ensuring that user experiences remain fluid and without complication.

The Role of Zero-Knowledge Proofs

Imagine you’re at a club, and you need to show your ID to get in, but you only want to prove you’re of age without giving away your birthdate. This is akin to how zero-knowledge proofs work in blockchain: users can verify their identity without disclosing sensitive information. HIBT is actively exploring advancements in this technology to align with EU MiCA’s privacy and security objectives.

Implementation Strategies for Crypto Firms

For crypto firms, adapting to MiCA can feel like taking a crash course in regulations. Just like mastering a new recipe, step-by-step strategies are essential. HIBT recommends firms assess their operations, review compliance measures, and potentially invest in compliance solutions to mitigate risks associated with the new regulations.

Conclusion

As the cryptocurrency landscape evolves with EU MiCA regulations, HIBT’s proactive response highlights the importance of compliance, interoperability, and innovative technologies like zero-knowledge proofs. By embracing these changes, firms can not only survive but thrive in this new regulatory environment.

Don’t miss out on our tools and resources. Download our compliance toolkit today!

Disclaimer: This article does not constitute investment advice. Please consult your local regulatory authority before engaging in any cryptocurrency activities.

Key Resources:

- Crypto Compliance White Paper

- Cross-Chain Security Solutions

- Exploring Zero-Knowledge Proofs

For more insights, follow us at bitcoinstair.