Understanding the HIBT RSI Indicator: A Guide for Cryptocurrency Traders

What is the HIBT RSI Indicator?

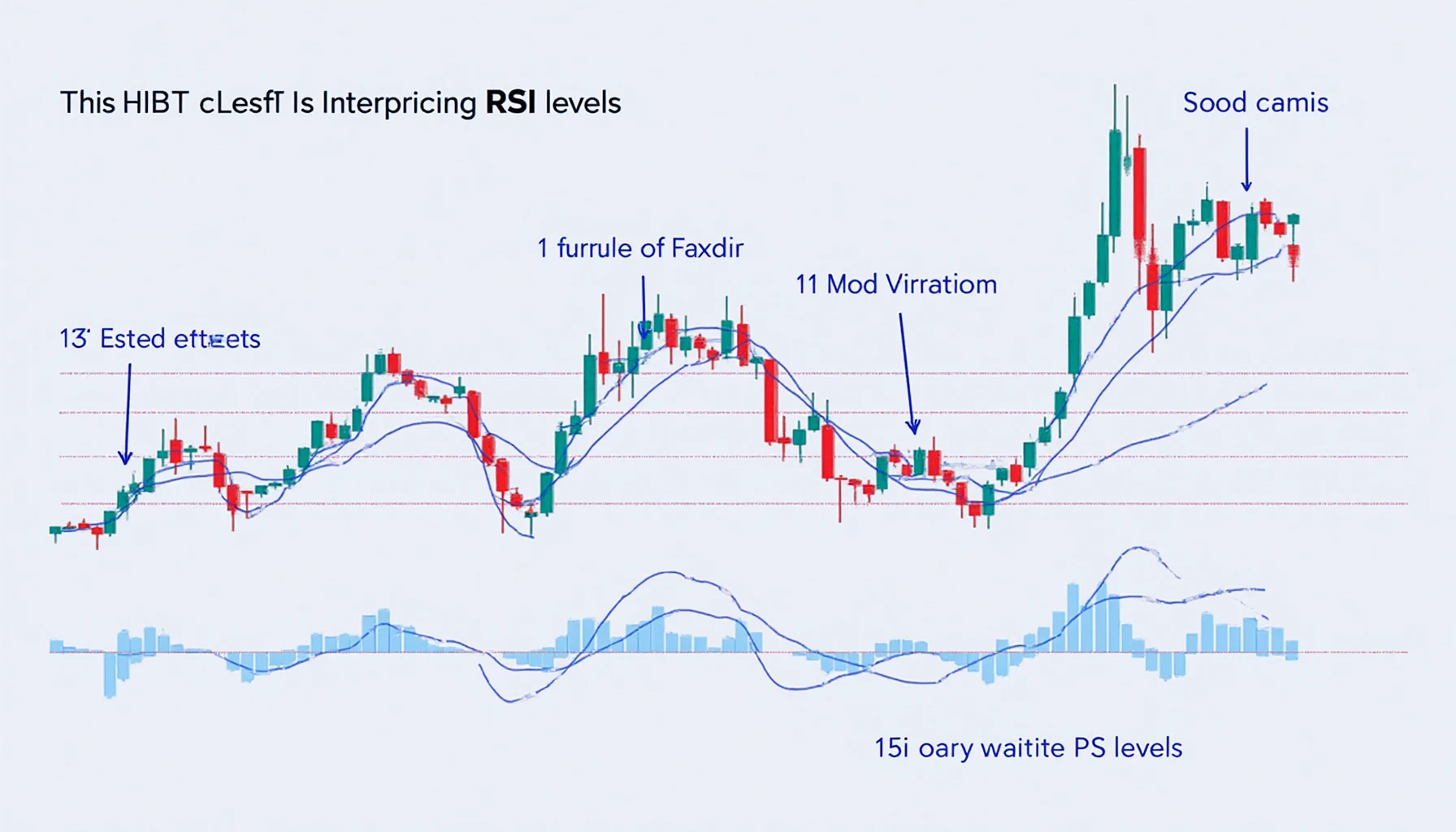

Have you ever wondered how professional traders make decisions in the volatile world of cryptocurrency? The answer often lies in technical indicators like the HIBT RSI Indicator. RSI, or Relative Strength Index, measures the speed and change of price movements. The HIBT version adds a twist, incorporating historical data for enhanced accuracy.

How Does the HIBT RSI Work?

The HIBT RSI operates on a scale from 0 to 100. A reading above 70 often indicates that the asset is overbought, while a reading below 30 suggests it is oversold. This can be crucial for digital currency trading, helping you identify optimal entry and exit points.

For instance, let’s say Bitcoin is showing an RSI of 75. This might signal to a trader that it’s time to sell or at least to be cautious about entering new positions. Conversely, a low RSI could present a buying opportunity.

Practical Applications of HIBT RSI in Crypto Trading

- Timing your trades: Using the HIBT RSI can help you decide when to buy or sell various altcoins, particularly important in fast-paced trading environments.

- Risk management: Understanding the RSI can guide your risk tolerance when investing. You might choose to hold back if an asset is overbought.

- Combining with other indicators: Pair the HIBT RSI with moving averages or MACD for a more comprehensive trading strategy.

Common Mistakes When Using HIBT RSI

Many traders make crucial mistakes when interpreting the HIBT RSI:

- Overconfidence in signals: Just because an asset has an overbought signal doesn’t guarantee a downturn.

- Ignoring market trends: Consider the overall market direction. RSI is best used in conjunction with other market indicators.

- Focusing on one timeframe: Analyze multiple timeframes to get a clearer picture of the market sentiment.

Case Study: HIBT RSI in Action

During the 2021 cryptocurrency boom, many traders relied on the HIBT RSI to navigate the tumultuous market. For example, Bitcoin’s price surged past $60,000. As the RSI approached 80, savvy traders began to offload part of their holdings, which ultimately protected their profits.

Conclusion: Mastering the HIBT RSI Indicator

The HIBT RSI Indicator is a powerful tool for those involved in the world of cryptocurrency trading. By understanding how to interpret its signals, you can enhance your trading strategies and improve your chances of success. For further insights on digital currency investment and the different methods available, explore our resources on HIBT.

Disclaimer: This article does not constitute financial advice. Always consult a financial advisor before making investment decisions.