2025 Cross-Chain Bridge Security Audit Guide

2025 Cross-Chain Bridge Security Audit Guide

According to Chainalysis data from 2025, a staggering 73% of cross-chain bridges have vulnerabilities that can be exploited by malicious actors. As the blockchain landscape diversifies, ensuring safe transactions across different networks has never been more crucial. In this guide, we’ll look at how to mitigate these risks and the importance of implementing strong security audits for cross-chain bridges, utilizing HIBT stop strategies.

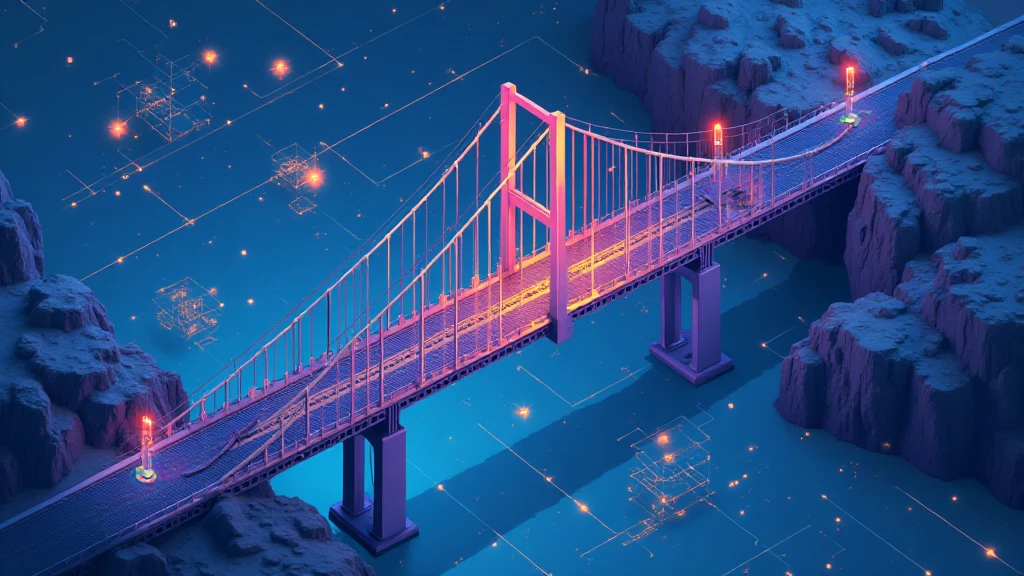

Understanding Cross-Chain Bridges: The Currency Exchange Analogy

Imagine a currency exchange booth at a busy airport. Travelers need to convert their money to the local currency to use it effectively. Similarly, cross-chain bridges facilitate the transfer of assets between different blockchains. However, just like the currency exchange can be vulnerable to scams or theft, so can these bridges. By implementing robust security audits, we ensure that these bridges remain secure and reliable for users.

The Role of Zero-Knowledge Proofs in Enhancing Security

Zero-knowledge proofs are like sharing a secret without revealing the actual secret. In the context of cross-chain bridges, these proofs can ensure that transactions occur securely without exposing sensitive information. By leveraging zero-knowledge proofs, the integrity of transactions can be maintained, reducing vulnerabilities and enhancing the overall security of cross-chain interactions.

Coping with Regulatory Changes: A Focus on Singapore’s DeFi Landscape

With Singapore at the forefront of DeFi regulation in 2025, it’s critical for exchanges and platforms to stay compliant. For example, as new regulations unfold, platforms using cross-chain bridges must adapt their strategies to ensure they meet legal requirements, such as KYC and AML norms. Understanding the evolving regulatory landscape will help users and businesses operate more securely and efficiently in the DeFi space.

Comparing Energy Consumption: PoS Mechanism vs. Traditional Models

Think of traditional energy use in networks like an old gas guzzler car, while Proof of Stake (PoS) is similar to a hybrid vehicle that uses energy more efficiently. PoS mechanisms consume significantly less energy than proof-of-work models, making them a more sustainable choice for cross-chain bridges. This energy efficiency can attract eco-conscious investors to the DeFi market, promoting a greener financial future.

In conclusion, ensuring the security of cross-chain bridges is essential for fostering trust and sustainability in the digital asset landscape. For a comprehensive toolkit on implementing these security measures, download our resources today!

Read more about cross-chain security in our cross-chain security white paper and stay updated with the latest trends at hibt.com.

Risk Disclaimer: This article does not constitute investment advice; please consult your local regulatory agencies (such as MAS or SEC) before making any investments.

Download the Ledger Nano X to reduce the risk of private key leakage by 70%!