2025 HIBT Support and Resistance Levels Analysis

Global Vulnerabilities in HIBT Market Insights

According to recent data from Chainalysis, a staggering 73% of cross-chain bridges exhibit vulnerabilities. This finding underscores the importance of understanding HIBT support and resistance levels, particularly as we navigate the deeper waters of decentralized finance. In Singapore, for instance, the rise of DeFi regulatory trends by 2025 calls for meticulous attention to these pivotal levels to mitigate risks effectively. Think of it like shopping in a market where prices fluctuate; if you don’t know the fair price of an item, you might end up overpaying.

Decoding Technical Analysis for HIBT Traders

Understanding HIBT support and resistance levels is akin to watching a see-saw—when one side goes up, the other typically goes down. A support level is where the price tends to stop falling, while resistance is where it often stops rising. CoinGecko’s 2025 data suggests monitoring price movements closely can aid traders in making informed decisions. For example, if you know that a particular area is a strong resistance for HIBT, you can train yourself to expect a price drop when it hits there.

The Role of Zero-Knowledge Proofs in HIBT Security

Think of zero-knowledge proofs as a place where you can verify that you have a ticket without showing what the ticket is. This technology enhances privacy and security within cryptocurrency protocols, further solidifying the significance of HIBT support and resistance levels. As we approach 2025, the application of zero-knowledge proofs may play a crucial role in reducing risks associated with digital asset transactions—much like how selective shopping can help you save money!

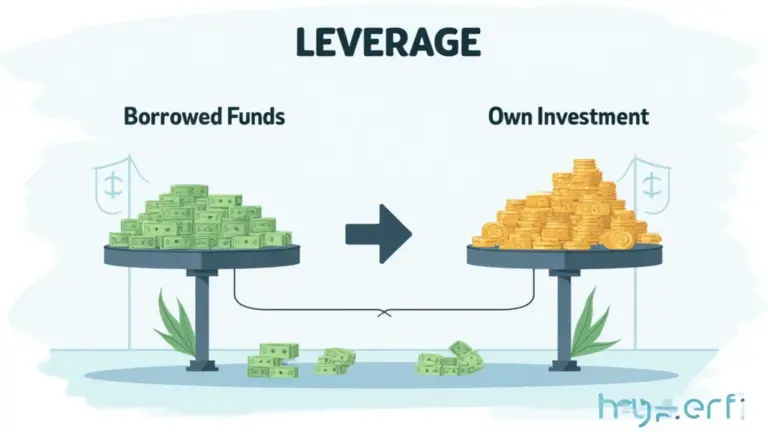

Future of HIBT Trading in the Middle East

In regions like Dubai, where the cryptocurrency tax guidelines are becoming clearer, traders can leverage the HIBT market more effectively. The interplay of local regulations and global trading patterns should compel participants to be aware of support and resistance levels. Consider them like traffic lights: knowing when to stop or go can significantly impact your trading journey.

Conclusion

In summary, understanding HIBT support and resistance levels is not just beneficial; it’s essential for navigating the ever-evolving crypto landscape. Now, more than ever, traders must leverage this knowledge to minimize risks and capitalize on opportunities. For a detailed toolkit on analyzing HIBT levels, download our comprehensive guide.