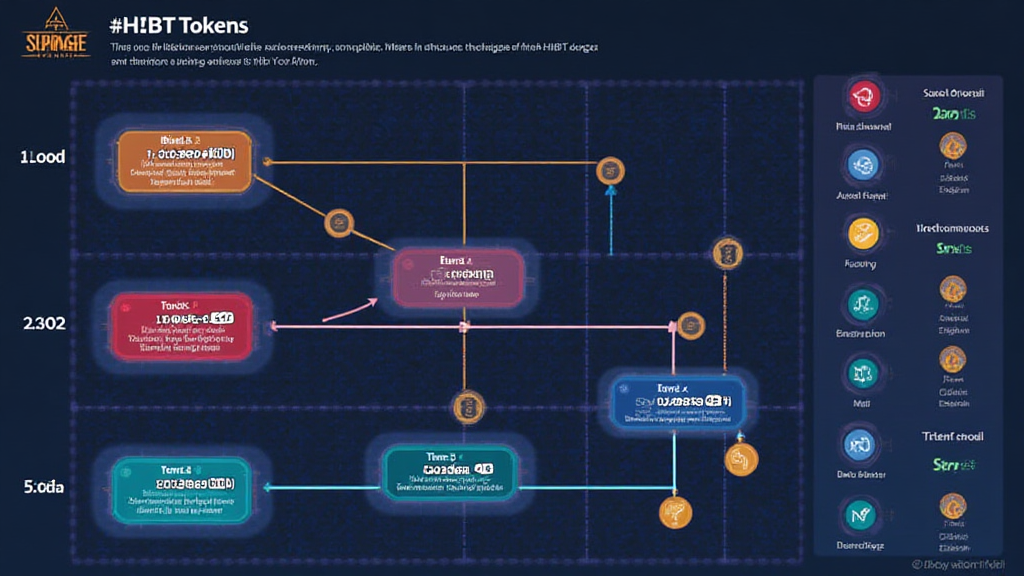

Understanding the HIBT Token Unlock Schedule: Key Insights

Introduction: Addressing Critical Blockchain Vulnerabilities

According to Chainalysis data from 2025, a staggering 73% of cross-chain bridges have identified vulnerabilities. As the cryptocurrency landscape evolves, so does the intricacy of token unlock schedules, especially with the HIBT token.

What is the HIBT Token Unlock Schedule?

The HIBT token unlock schedule is akin to a concert ticketing system—if you don’t unlock them at the right time, you might miss the show. Essentially, this schedule dictates when the tokens become available for trading post-ICO, which can directly influence market liquidity. Understanding this schedule helps investors strategize their buying and selling plans.

Impact on Market Dynamics

Much like a farmer harvesting crops, the way tokens are unlocked affects market supply. If many HIBT tokens are unlocked at once, it could lead to a supply surge, depressing prices temporarily. Conversely, gradual unlocks might create sustained interest in the token. Managing these dynamics is crucial for maintaining a balanced market.

Regional Comparison: South East Asia’s Growing Role in DeFi

In regions like Singapore, the evolving DeFi regulations aim to safeguard investors while fostering innovation. The 2025 regulatory trends in Singapore emphasize risk management in token unlock schedules, aligning interests between developers and investors. Understanding how different regions approach these regulations can provide insights into a token’s long-term viability.

Technological Security Measures

Think of blockchain security like a high-tech vault. The implementation of zero-knowledge proofs can enhance the security of unlocking tokens by ensuring that transactions are validated without needing to reveal the user’s private information. This technology can give users more confidence during the token unlock process.

Conclusion: Staying Informed and Prepared

In summary, the HIBT token unlock schedule remains a pivotal factor in the cryptocurrency market. As the landscape continues to shift, staying updated can empower investors to make informed decisions. Interested in detailed insights? Download our comprehensive toolkit for deeper understanding.

Disclaimer: This article does not constitute investment advice. Please consult your local regulatory authorities (such as MAS or SEC) before making any investment decisions.