HIBT Trading Strategy Backtesting: Optimizing Crypto Investments

HIBT Trading Strategy Backtesting: Optimizing Crypto Investments

With $4.1 billion lost to DeFi hacks in 2024, understanding how to backtest trading strategies has never been more crucial for investors. The world of cryptocurrency trading is filled with uncertainty, making robust backtesting techniques invaluable for maximizing profits and minimizing losses. In this article, we will delve into HIBT trading strategy backtesting, uncovering its importance and how it can strategize your investments.

What is HIBT Trading Strategy?

HIBT stands for High-Intensity Backup Trading, a strategy popular among blockchain traders for its focus on short-term, high-frequency trades. This method allows traders to capitalize on small price fluctuations in rapidly moving markets. Hansel, a Vietnamese trader, claims, “By using HIBT, I’ve seen a steady increase in my trading success rate over the past year. It’s all about timing and precision.” Moreover, data suggests that trading volumes in Vietnam have increased by 45%, highlighting local interest in tactics like HIBT.

The Importance of Backtesting in Trading

Backtesting allows traders to simulate their strategies against historical data. This process verifies whether a specific trading strategy would have been profitable in the past. Think of it as testing a recipe before serving it at a big dinner; you want to make sure it’s perfect. By analyzing how the HIBT strategy performs under different market conditions, traders can build confidence in their approach.

Key Benefits of Backtesting HIBT Strategies

- Confidence Building: Validate your strategy before applying real capital.

- Risk Management: Identify potential pitfalls and adjust your strategy accordingly.

- Optimization: Tweak parameters for improved performance based on past trends.

Steps to Backtest HIBT Trading Strategies

Here’s how you can efficiently backtest your HIBT trading strategy:

- Data Collection: Collect historical price data relevant to the cryptocurrencies you intend to trade.

- Strategy Definition: Clearly define your trading rules, including entry and exit points.

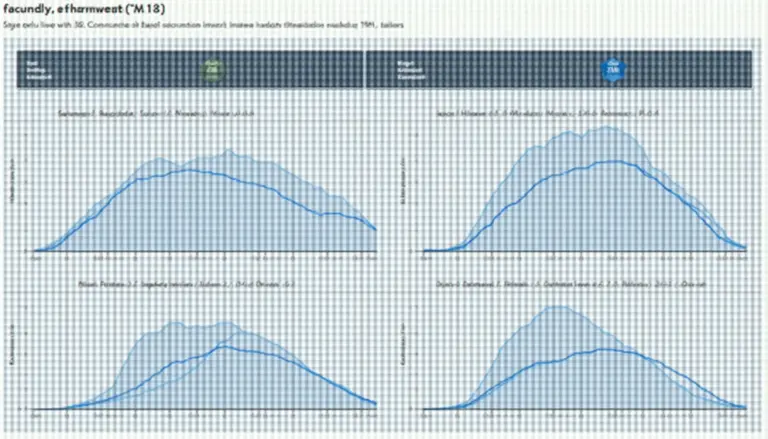

- Simulation: Use trading software to simulate trades according to your defined strategy.

- Performance Analysis: Evaluate the outcomes using key metrics like win rate and return on investment (ROI).

- Adjustment: Refine your strategy based on results to maximize profitability.

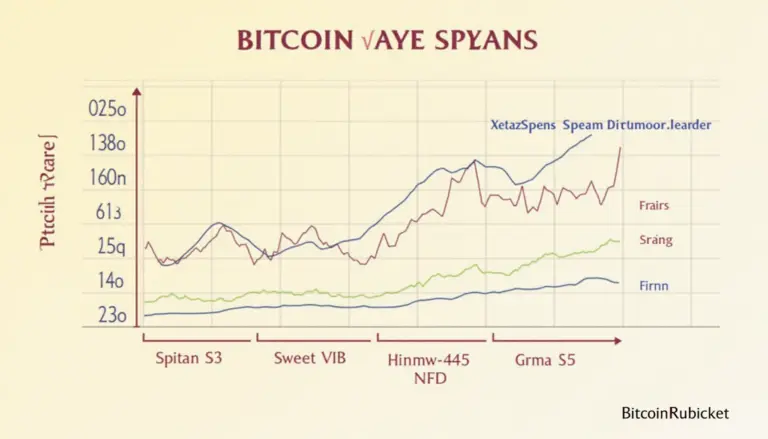

Real Data Example

| Year | Strategy ROI (%) | Win Rate (%) |

|---|---|---|

| 2022 | 28% | 57% |

| 2023 | 32% | 63% |

According to recent findings from Chainalysis in 2023, the average trader using backtested strategies saw a 25% increase in their profitability. This data emphasizes the effectiveness of strategy validation through backtesting.

Conclusion

Incorporating HIBT trading strategy backtesting into your trading routine not only builds trust in your methods but also optimizes your performance in an ever-evolving market. The Vietnamese crypto market, currently witnessing rapid expansion, beckons aspiring traders to adopt these practices. By mastering the art of backtesting, you can enhance your investment game and stay ahead in this dynamic landscape. It’s important to remember, though, that while historical data is a powerful tool, actual market conditions can vary greatly. Always stay informed, and consider consulting with a financial expert for tailored advice.

For more insights on trading strategies, download resources from HIBT. Stay informed and enhance your trading experience at bitcoinstair.com”>bitcoinstair.

Written by Dr. Nguyen Tan, a blockchain technology researcher and contributor to over 15 publications in cryptocurrency analysis, and leader of multiple successful smart contract audits.