HIBT Treasury Fund Allocation Explained

Understanding HIBT Treasury Fund Allocation

As the rapid growth of the cryptocurrency market continues, effective treasury fund allocation becomes crucial for platforms like HIBT. With over $4.1 billion lost to DeFi hacks in 2024, understanding how treasury funds are managed is vital for ensuring safety and sustainability.

Why Treasury Fund Allocation Matters

Imagine your investment portfolio as a well-structured financial ladder. If any rung is weak, the entire structure can collapse. This analogy perfectly illustrates the significance of effective fund allocation. HIBT employs a prudent allocation strategy, focusing on security, growth, and flexibility. By diversifying investments across different assets, HIBT minimizes risks and optimizes returns.

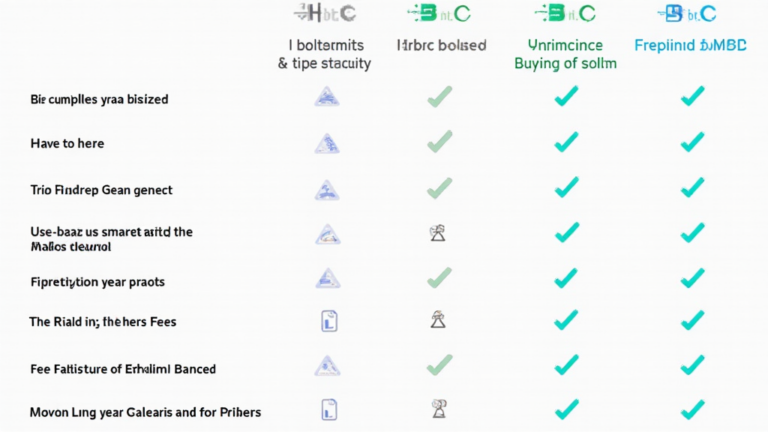

Typical Fund Allocation Strategies

- Liquidity Reserves: A portion of funds is held in stablecoins and fiat currencies to ensure immediate responsiveness during market fluctuations.

- Investments in Digital Assets: HIBT allocates funds to promising cryptocurrencies and innovative projects likely to yield significant returns, contributing to stability.

- Staking and Yield Farming: These strategies are used to generate passive income, effectively leveraging additional revenue streams.

The Role of Data in Fund Allocation

Real-world data drives HIBT’s decision-making. For instance, according to Chainalysis 2025 report, over 54% of cryptocurrency investors in Vietnam are now actively participating in DeFi projects. This rising interest guides HIBT’s investments and engagement strategies.

Compliance and Security Protocols

To protect these allocations, HIBT employs advanced security measures adhering to the tiêu chuẩn an ninh blockchain. Regular audits are conducted, ensuring compliance with local regulations and boosting trust among investors.

Conclusion: A Strategic Approach to Fund Allocation

In summary, understanding HIBT’s treasury fund allocation is essential for making informed investment decisions. Secure and diversified funds help mitigate risks while maximizing potential returns. By keeping abreast of market trends—like the growing Vietnamese user base—investors can align their strategies effectively.

For more detailed information, check out HIBT’s informational resources.