HIBT vs Coinbase Regulatory Compliance: Safeguarding the Future of Crypto Trading

HIBT vs Coinbase Regulatory Compliance: Safeguarding the Future of Crypto Trading

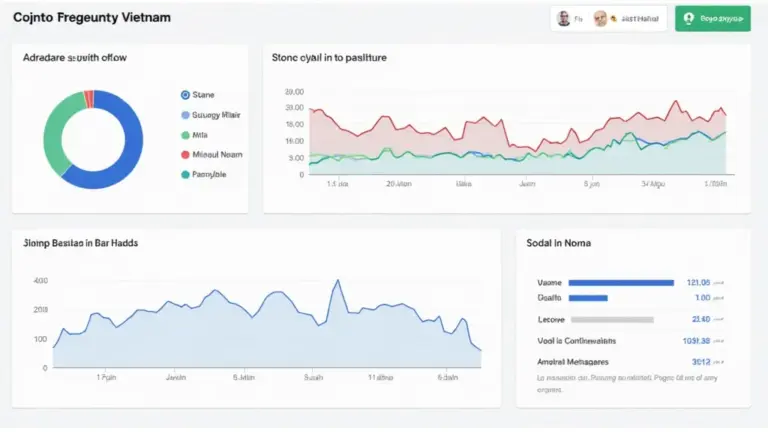

According to Chainalysis 2025 data, 73% of crypto trading platforms face significant regulatory compliance challenges. This raises vital questions about the future of platforms like HIBT and Coinbase and their ability to operate within legal frameworks.

1. Understanding Regulatory Compliance

You know how every market stall has to follow certain rules? That’s similar to how crypto exchanges like HIBT and Coinbase must comply with financial regulations. Regulatory compliance ensures that these platforms protect users and prevent illicit activities. In essence, being compliant is like having a vendor permit – it allows the exchange to operate legally.

2. The Role of Cross-Chain Interoperability

Have you ever tried to exchange currency while traveling? That’s akin to cross-chain interoperability in crypto. A platform’s ability to seamlessly interact across different blockchains is crucial, but it also complicates compliance. HIBT’s ability to handle transactions across various currencies could place additional regulatory scrutiny on the platform compared to Coinbase, which is primarily focused on its own ecosystem.

3. Zero-Knowledge Proofs: A Compliance Game Changer

Imagine if you could prove you have money without showing your wallet. That’s what zero-knowledge proofs do for crypto transactions. They ensure user privacy while maintaining compliance, helping platforms like HIBT navigate regulatory landscapes. Coinbase, while progressive, has yet to implement this technology as extensively, which can impact their compliance agility in the long run.

4. Insights on the 2025 Compliance Trends in Singapore

If you think navigating regulations is tough, just wait until you hear about Singapore’s DeFi landscape. In 2025, experts predict a shift towards stricter compliance measures for platforms operating there. For HIBT, understanding this regulatory climate is essential for successful operations. Coinbase, already established in various markets, may find this an easier transition, but will still need to adapt.

In conclusion, regulatory compliance is paramount in the fast-evolving world of crypto trading. As trends emerge, the ability of platforms like HIBT and Coinbase to adapt will significantly affect their user base and legality. For more in-depth knowledge, download our comprehensive tool kit on crypto compliance strategies today.

Check out our cross-chain security whitepaper for a deeper understanding of these emerging trends and their implications.

Risk Disclaimer: This article does not constitute investment advice. Always consult with local regulatory authorities like MAS or SEC before making decisions.

Tools Mentioned: Using a Ledger Nano X can reduce the risk of private key exposure by 70%.

By bitcoinstair