HIBT’s Approach to Crypto Regulatory Arbitration in 2025

HIBT’s Approach to Crypto Regulatory Arbitration in 2025

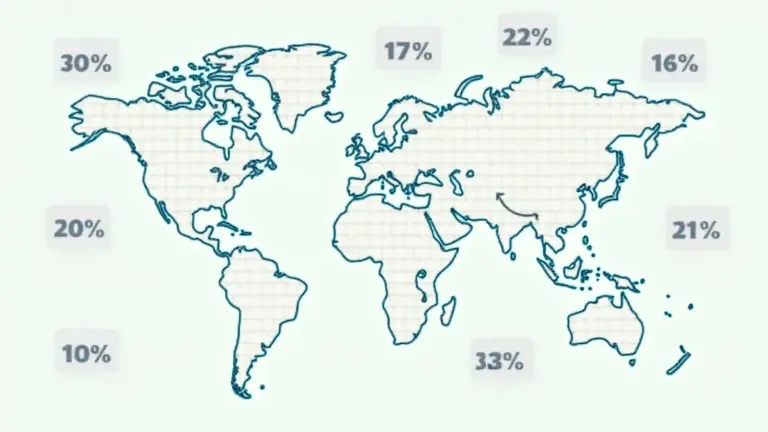

According to Chainalysis 2025 data, a staggering 73% of global crypto exchanges are facing regulatory scrutiny, indicating an ongoing challenge for compliance and safety in the industry. HIBT aims to take the lead with a structured approach to crypto regulatory arbitration in 2025.

Understanding Cross-Chain Interoperability

Imagine you go to a currency exchange booth at the airport. You want to buy euros with dollars. The booth takes your dollars, and they give you euros in return. Cross-chain interoperability works similarly but on a digital level, allowing different blockchains to communicate and interact with each other. In 2025, HIBT believes that seamless cross-chain transactions will become essential for mainstream adoption.

The Role of Zero-Knowledge Proofs

Think of zero-knowledge proofs like a parent vouching for their child’s honesty without revealing all their secrets. It allows data to be verified without exposing the data itself. This concept is set to revolutionize privacy in crypto transactions in 2025, offering security and transparency without compromising on user confidentiality. HIBT’s approach will leverage these techniques to assure regulators and users alike.

2025 Singapore DeFi Regulatory Trends

In Singapore, the regulatory landscape for Decentralized Finance (DeFi) is poised to evolve significantly. Regulations are expected to focus on transparency and security, akin to how banks operate. HIBT’s strategies will incorporate local guidelines and trends to ensure compliance, claiming that adhering to DeFi transparency could lead to greater trust and wider adoption.

PoS Mechanism Energy Consumption Comparison

Consider the difference between a car that runs on petrol and one that’s electric. The latter is often more energy-efficient. This analogy can apply to Proof of Stake (PoS) mechanisms, which are expected to be central to blockchain network efficiency in 2025. HIBT aims to educate stakeholders on these benefits and promote energy-efficient technologies for blockchain applications that comply with future regulations.

In conclusion, HIBT’s approach to crypto regulatory arbitration in 2025 focuses on driving innovation while ensuring compliance with emerging regulations. Download our toolkit to find out more about navigating these changes in the crypto landscape.