2025 Cross-Chain Bridge Security Auditing Guide

Introduction

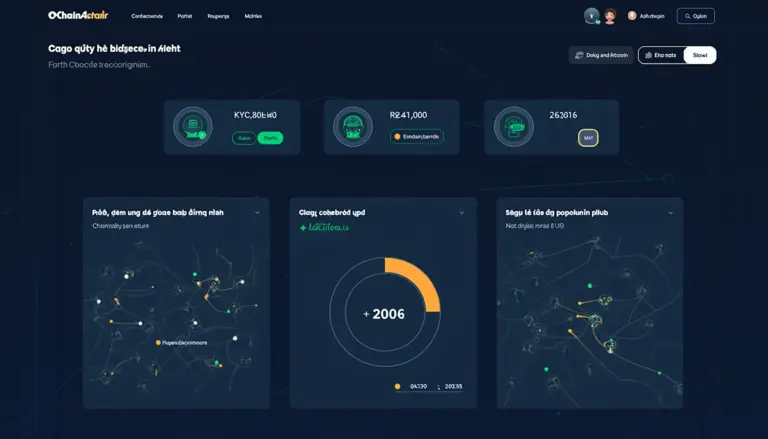

According to Chainalysis 2025 data, an alarming 73% of cross-chain bridges have vulnerabilities. As the cryptocurrency landscape expands, ensuring compliance with HIBT’s crypto asset listing regulatory compliance guides becomes essential for keeping assets secure.

What are Cross-Chain Bridges?

Think of cross-chain bridges like currency exchange booths at the airport where you can trade one currency for another. These bridges allow users to move assets from one blockchain to another. However, just like you wouldn’t want to use a sketchy exchange, it’s crucial to choose secure and compliant bridges.

Importance of Regulatory Compliance

Regulatory compliance is like having a good umbrella when it rains; it protects you from potential downpours of legal issues. By following HIBT’s guidance on crypto asset listings, users can mitigate risks and ensure they’re trading safely. A compliant exchange can significantly reduce the chance of scams or hacks.

Understanding Zero-Knowledge Proof Applications

Zero-knowledge proofs might sound complicated, but they’re like a magic trick that lets one party prove to another that they know a secret without revealing the secret itself. This technology is particularly relevant for ensuring privacy and security in crypto transactions, aligning with HIBT’s compliance standards.

Key Trends for 2025: DeFi Regulation in Singapore

Looking at the future, Singapore’s DeFi regulations are anticipated to become increasingly transparent. It’s akin to moving from a foggy day to a bright sunny one where everyone can see clearly. Keeping an eye on these trends is essential for investors, as regulations will directly impact how assets are traded and secured.

Conclusion

In summary, navigating through the complexities of crypto regulations and security measures is crucial for every investor. It’s highly recommended to download our compliance toolkit below to better understand HIBT’s guidelines and safeguard your cryptocurrency investments.