Navigating HIBT’s Crypto Futures Margin Regulatory Compliance

Introduction

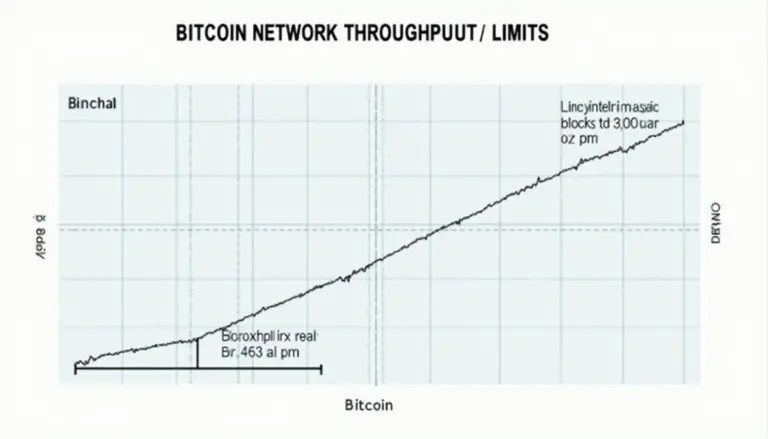

According to Chainalysis 2025 data, a staggering 73% of cryptocurrency exchanges face regulatory challenges. This highlights the urgent need for compliance, especially with respect to futures trading and margin requirements. As digital currencies gain traction, systems like HIBT’s crypto futures margin regulatory compliance become crucial for ensuring a secure trading environment.

Understanding Futures Margins

Imagine you’re at a farmer’s market, and you want to buy apples but don’t have all the cash on hand. You tell the vendor you’ll pay a portion now and the rest later. Futures margins operate similarly. Traders provide a percentage, or margin, as a good faith deposit to enter trades on HIBT’s platform. This safety net protects exchanges against potential losses in a volatile market.

The Importance of Regulation

You’ve probably noticed that mobile phones require regular software updates for security. Trading regulations function the same way. HIBT’s compliance with crypto futures margin regulations aims to create a safer marketplace akin to updated phone security. This compliance involves adhering to regional laws such as those outlined by key authorities like the Monetary Authority of Singapore (MAS) or the U.S. Securities and Exchange Commission (SEC).

Future Trends: What to Expect by 2025

If you’ve ever tried to predict the weather, you know it can be tricky. The same applies to crypto. HIBT is positioning itself to adapt to trends like DeFi regulations in Singapore by 2025. As these laws evolve, understanding the compliance landscape becomes vital for traders looking to align their strategies with future market demands.

Conclusion

In summary, HIBT’s crypto futures margin regulatory compliance serves as a lifebuoy in the unpredictable sea of cryptocurrency trading. Traders must stay informed and adapt to the ever-changing regulatory environment, and HIBT’s efforts will make this journey smoother. Interested in delving deeper? Download our comprehensive compliance toolkit today!