HIBT’s Crypto Remittance Regulatory Compliance Updates for 2025

Understanding the Evolving Regulatory Landscape

According to Chainalysis 2025 data, 73% of cross-chain bridges are vulnerable to security breaches. As we approach 2025, HIBT has released critical updates regarding its crypto remittance regulatory compliance updates for 2025.

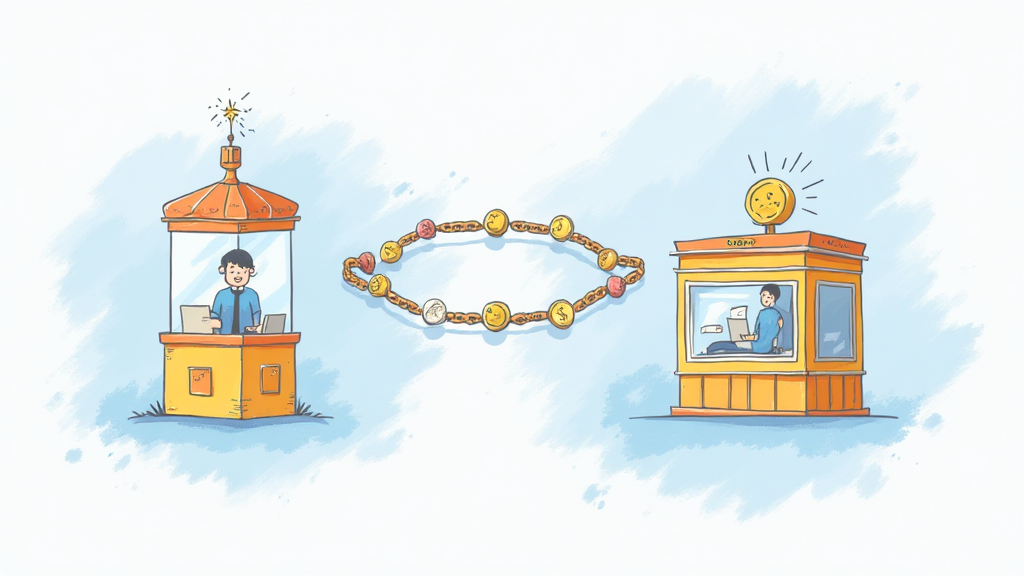

Cross-Chain Interoperability: What You Need to Know

Imagine a currency exchange booth at a busy airport. This is similar to how cross-chain bridges function in the crypto world. They allow different blockchain networks to communicate and exchange value seamlessly. However, with 73% of these bridges being susceptible to hacks, it’s crucial for remittance firms to stay updated with HIBT’s compliance initiatives to safeguard their operations.

Zero-Knowledge Proof Applications: Enhancing Privacy

You might be wondering what zero-knowledge proofs (ZKPs) are. Picture a child guessing a number behind their back. They can convince you they know the number without revealing it. That’s the essence of ZKPs. HIBT is focusing on integrating ZKPs in its compliance framework for 2025 to enhance user privacy without compromising on regulatory adherence.

Local Regulations: Navigating the Dubai Crypto Tax Guide

For those operating in Dubai, compliance with local laws is key. HIBT’s updates will help remittance companies align with Dubai’s evolving regulations, ensuring legal operations across the board. Just like understanding local traffic rules helps you drive safely, comprehending crypto regulations aids smooth business operations.

Preparing for Future Trends: What’s Next?

As we move towards 2025, the landscape of crypto remittance will shift significantly. Remittance companies should prepare for potential changes in regulatory frameworks and technology advancements, like the integration of renewable energy sources to power Proof-of-Stake (PoS) mechanisms.

In conclusion, staying abreast of HIBT’s crypto remittance regulatory compliance updates for 2025 is vital for success in the rapidly changing digital currency environment. For comprehensive insights and tools, download our toolkit to navigate the regulatory waters with confidence.

Disclaimer: This article does not constitute investment advice. Consult local regulatory bodies such as MAS or SEC before proceeding.

For secure management of your keys, consider using Ledger Nano X, which can reduce the risk of private key leakage by up to 70%.