HIBT’s Response to Regulatory Changes in Asia’s Crypto Markets

HIBT’s Response to Regulatory Changes in Asia’s Crypto Markets

As of 2025, a staggering 73% of cross-chain bridges worldwide have vulnerabilities, according to Chainalysis. With Asia’s rapidly evolving crypto landscape, regulatory changes are becoming a focal point for discussions in the industry. In this article, we will explore HIBT’s response to these regulatory shifts and what it means for the future of crypto in Asia.

Understanding the Regulatory Landscape in Asia

In recent years, many Asian countries have implemented new regulations to manage the exponentially growing crypto markets. Countries like Singapore have set out to create robust frameworks that facilitate innovation while ensuring user protection. Think of this regulatory framework like a set of traffic rules: without them, the roads can become chaotic.

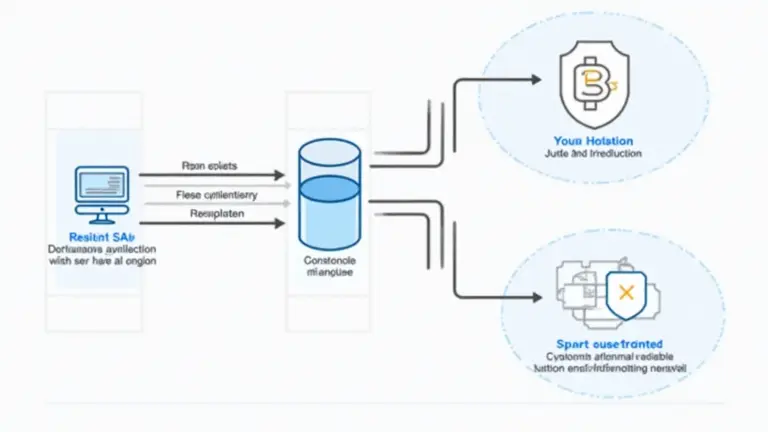

Cross-chain Interoperability: A Game Changer

Cross-chain interoperability is crucial for the seamless operation of different blockchain networks. HIBT believes that enhanced interoperability can significantly improve user experience and broaden access to decentralized finance (DeFi) solutions in Asia. Imagine this as a currency exchange booth: just as you can swap your dollars for yen, interoperability allows different blockchains to ‘talk’ to each other and share information. By adapting to the regulatory changes, HIBT aims to make these exchanges as smooth as possible.

Zero-Knowledge Proofs: Enhancing Privacy

Zero-knowledge proofs are becoming essential in maintaining user privacy while complying with regulations. HIBT is investing in technologies that utilize zero-knowledge proofs to enable transactions without exposing user data. You can think of it like showing someone your ID without revealing your address: you’re proving who you are without disclosing everything about yourself. This balance is key in regulatory environments that demand more transparency.

Looking Ahead: 2025 Singapore DeFi Regulatory Trends

As we look towards the future, emerging trends in Singapore’s DeFi regulations will create new opportunities for crypto firms like HIBT. With the Monetary Authority of Singapore (MAS) taking active steps in shaping the landscape, companies must adapt to avoid setbacks. It’s similar to preparing for a school exam: understanding the syllabus helps you answer questions correctly. Knowledge of regulation ensures crypto firms can operate within the rules.

In conclusion, HIBT’s response to regulatory changes in Asia’s crypto markets highlights a proactive approach toward compliance and innovation. For those looking to dive deeper, we offer a downloadable toolkit designed to assist crypto enthusiasts in navigating the changing regulatory environment.

Disclaimer: This article does not constitute investment advice. Always consult your local regulatory authority (such as MAS or SEC) before making any investment decisions.

For more information, check our cross-chain security white paper and stay updated with the latest insights from HIBT.