HIBT’s Response to Regulatory Changes in MiCA’s Implementation: A Deep Dive

Introduction

According to Chainalysis, over 73% of cross-chain bridges exhibit vulnerabilities, which raises significant concerns in the rapidly evolving crypto landscape. As the MiCA (Markets in Crypto-Assets) regulation comes into full force, understanding the potential ramifications is crucial for all stakeholders involved.

1. What is MiCA and Why Does It Matter?

MiCA is a landmark regulation aimed at providing a regulatory framework for crypto assets across the European Union. Think of it as a set of rules for operating a food market, where every stall must follow hygiene and safety standards for customers’ sake. These regulations will ensure safer participation in the crypto space and could curb the rampant fraud currently seen in the industry.

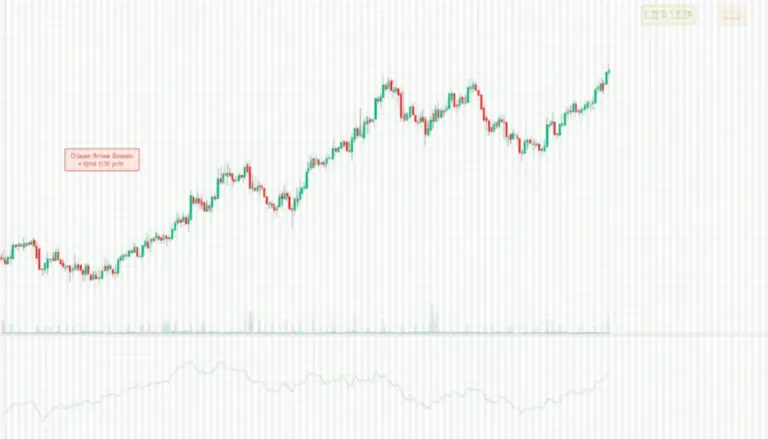

2. HIBT’s Response: Strengthening Cross-Chain Interoperability

HIBT is focusing on enhancing cross-chain interoperability in response to MiCA’s requirements. Imagine you’re trying to exchange currency at different country booths in a market—cross-chain interoperability works similarly where different blockchains can communicate and transact seamlessly. This response will not only comply with new regulations but also foster a more connected crypto ecosystem.

3. The Role of Zero-Knowledge Proofs in Compliance

Zero-knowledge proofs (ZKPs) are like a vendor who confirms the freshness of meat without showing you the whole animal. These cryptographic tools allow one party to prove to another that a statement is true without revealing the underlying information. HIBT plans to utilize ZKPs to help meet compliance under MiCA while still protecting user privacy.

4. Future Trends: Projecting into 2025 and Beyond

As we look towards 2025, the regulatory landscape will evolve, particularly in DeFi (Decentralized Finance). Countries like Singapore are expected to establish clear regulatory frameworks that allow innovation while protecting investors. Similar to how earlier food markets evolved into producers, sellers, and consumers coexisting, we anticipate a balanced relationship between regulation and innovation in DeFi.

Conclusion

In conclusion, HIBT’s response to regulatory changes in MiCA’s implementation highlights the commitment to a safer, more compliant crypto environment. As you navigate these changes, consider utilizing tools like the Ledger Nano X, proven to reduce the risk of private key exposure by 70%. For further insights, feel free to download our toolkit that offers detailed strategies to navigate the evolving regulatory landscape in crypto.