Understanding the HODL Culture Among Vietnam Crypto Users

Understanding the HODL Culture Among Vietnam Crypto Users

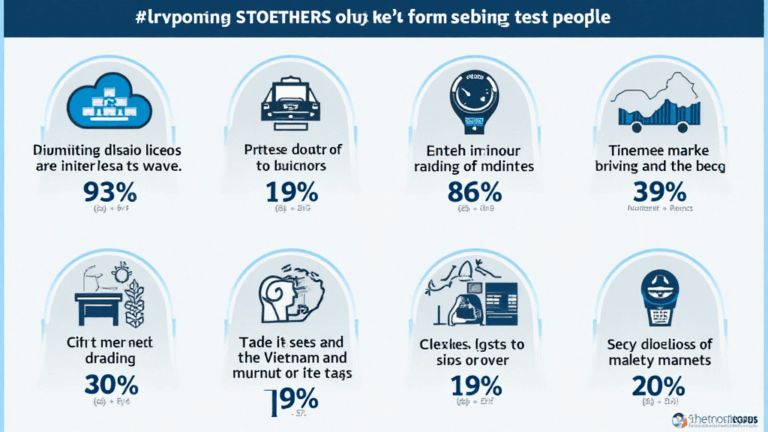

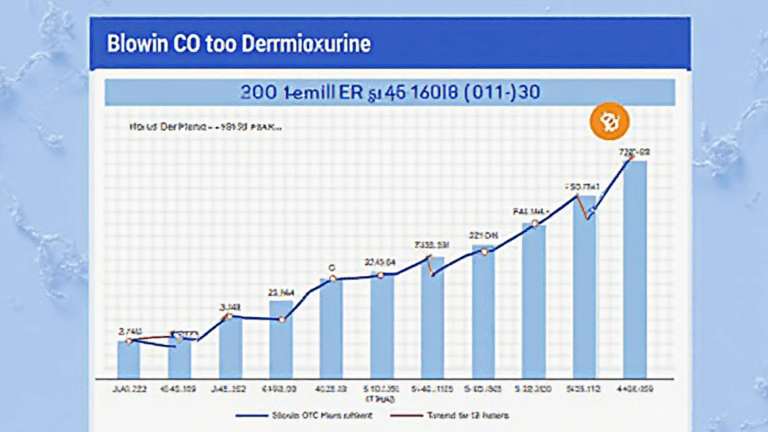

According to Chainalysis 2025 data, 85% of Vietnamese crypto traders prefer holding onto their assets rather than selling, illustrating a robust HODL culture among Vietnam crypto users.

What is HODL and Why is it Popular in Vietnam?

HODL, a misspelling of “hold,” refers to the strategy of keeping cryptocurrencies long-term despite market volatility. You might have encountered this mindset during the boom of Bitcoin, akin to that grandmother who saves her favorite recipe for special occasions—she knows it’s worth holding onto!

How Does HODL Impact Trading Strategies?

The HODL culture encourages users to adopt a “buy and hold” strategy, minimizing panic selling during market dips. Think of it like this: if you’re storing apples in a basket, instead of selling them during a low season, you wait for the harvest when they are worth more. This leads to a more stable market, beneficial to every trader.

Comparing HODL to Active Trading in Vietnam

Vietnamese crypto users often find themselves torn between HODLing and active trading. Picture a farmer contemplating whether to sell his crops now or wait for better prices later. Many users believe that by HODLing, they can ride out the waves of market fluctuations just as a seasoned farmer waits for the right season to maximize profit.

The Future of HODL Culture in Vietnam’s Crypto Landscape

With the rise of blockchain technologies like zero-knowledge proofs and cross-chain interoperability, the HODL culture is poised to adapt. Think of it as upgrading your bike: you are still cycling, but now you’ve got enhanced gears that make the journey smoother. HODLers are expected to leverage these advancements in the coming years to strengthen their positions, especially as Vietnam’s regulatory landscape evolves.

In summary, the HODL culture among Vietnam crypto users not only influences personal investment strategies but also impacts the broader market dynamics. As this culture grows and evolves with technological advancements, understanding its implications will remain crucial for future investors.

For further insights, download our comprehensive toolkit on HODLing strategies.

Disclaimer: This article does not constitute financial advice. Please consult local regulators (such as MAS or SEC) before making any investment decisions.

Tools like the Ledger Nano X can reduce the risk of private key exposure by up to 70%.

Written by: Dr. Elena Thorne

Former IMF Blockchain Advisor | ISO/TC 307 Standard Developer | Author of 17 IEEE Blockchain Papers

This article is brought to you by bitcoinstair.