How Bitcoin Works Explained: Understanding the Basics

How Bitcoin Works Explained

Bitcoin, the pioneering cryptocurrency, revolutionized our understanding of digital currency and payment systems. But how does Bitcoin actually work? Exploring this question reveals a fascinating blend of technology, security, and economic theory.

Pain Points in Understanding Bitcoin

Many potential investors find themselves confused by the complexities of cryptocurrency. For instance, the barriers to entry seem daunting. Users frequently worry about how Bitcoin works when it comes to its decentralized nature and security. Furthermore, there’s the concern about the anonymity of transactions, which can be a double-edged sword. All these concerns create hesitancy, ultimately impacting their investment decisions.

In-Depth Analysis of How Bitcoin Works

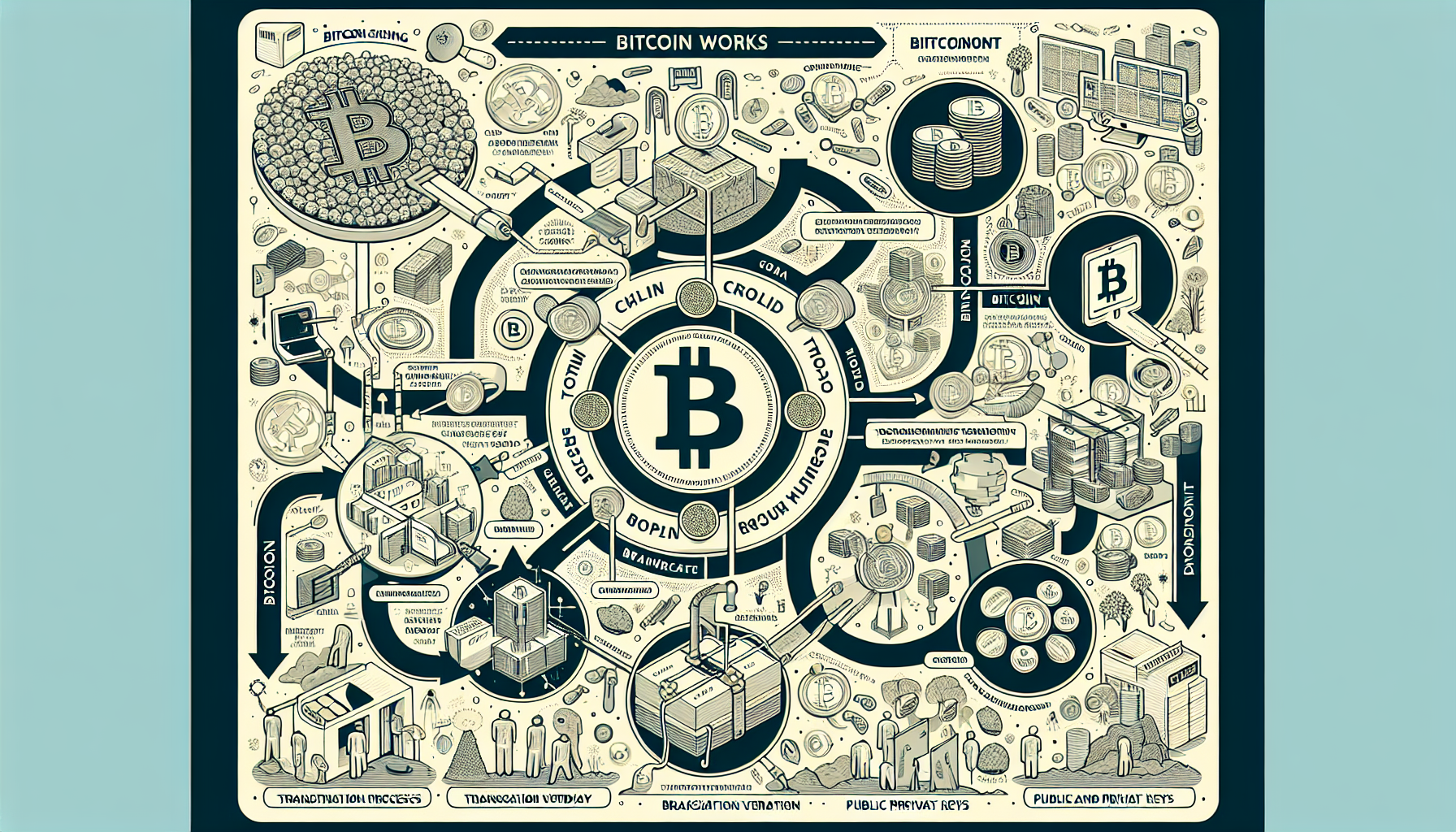

To understand how Bitcoin works, consider these crucial components:

- Blockchain Technology: At the heart of Bitcoin’s operation is the blockchain—a distributed ledger that records all transactions. This ensures transparency and eliminates the need for a central authority.

- Mining: Miners are nodes that validate transactions by solving complex mathematical puzzles. They are rewarded with newly minted Bitcoins.

- Wallets: Users store their Bitcoins in digital wallets, which can be software-based or hardware-based, enabling secure access and management.

Let’s compare two scenarios of Bitcoin implementation:

| Parameter | Scenario A | Scenario B |

|---|---|---|

| Security | High (due to blockchain integrity) | Moderate (centralized exchanges vulnerable) |

| Cost | Low (transaction fees mainly) | High (exchange fees and withdrawal fees) |

| Applicable Situations | Peer-to-peer transactions | Investment and trading |

The trends in cryptocurrency adoption are on the rise. According to a recent Chainalysis report, as of 2025, an estimated 1 billion users are expected to participate in the cryptocurrency economy, endorsing Bitcoin’s potential as a mainstream asset.

Risk Warnings: What You Should Consider

While understanding how Bitcoin works is crucial, it’s equally important to recognize the risks involved. **Ensure to use secure wallets** to mitigate the risk of theft. Additionally, consider diversifying your cryptocurrency portfolio to spread your risk across multiple assets. Be wary of unregulated exchanges, as they can pose significant security issues.

As we delve into Bitcoin investing, it is vital to stay informed and educated. At bitcoinstair, we equip our users with the tools and knowledge necessary to navigate the cryptocurrency landscape effectively.

In conclusion, understanding how Bitcoin works not only empowers individuals but also enhances confidence in digital investments. With its inherent features and growing acceptance, Bitcoin presents an unprecedented opportunity in today’s financial world.

FAQ

Q: What is Bitcoin?

A: Bitcoin is a decentralized digital currency that uses blockchain technology for secure transactions. Understanding how Bitcoin works is essential for anyone interested in investing.

Q: How can I buy Bitcoin safely?

A: To buy Bitcoin safely, ensure you use reputable exchanges, secure your digital wallets, and stay informed about market trends. Learn more about how Bitcoin works before making investments.

Q: What are the risks of investing in Bitcoin?

A: The primary risks include market volatility, security issues with exchanges, and regulatory changes. Knowing how Bitcoin works can help mitigate these risks.

Author: John Smith, a financial analyst and cryptocurrency expert with over 15 publications focusing on blockchain technology and security audits of notable crypto projects.