How HIBT Educates Users on Regulations in Crypto

How HIBT Educates Users on Regulations in Crypto

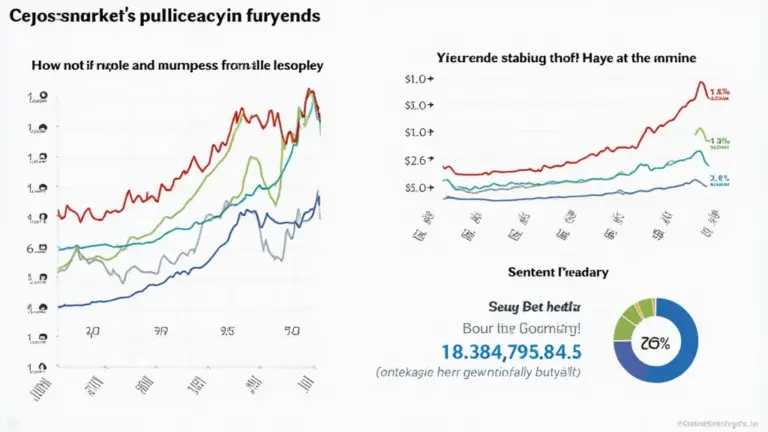

According to Chainalysis data from 2025, over 73% of cross-chain bridges exhibit vulnerabilities, underscoring the critical need for user education on regulations.

Understanding Crypto Regulations: What Users Need to Know

In simple terms, think of crypto regulations like traffic rules. Just as cars must follow speed limits, cryptocurrencies must comply with legal frameworks to operate safely. HIBT provides resources to help users understand the regulatory landscape, ensuring they stay on the right side of the law.

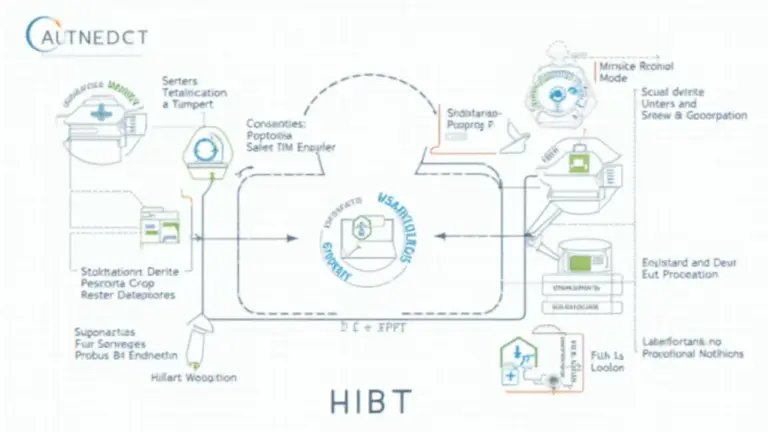

The Role of Cross-Chain Interoperability

Imagine currency exchange booths at an airport. You can trade dollars for euros, and with cross-chain bridges, cryptocurrencies can interact with each other seamlessly. HIBT emphasizes the importance of understanding these interactions and their regulatory implications to prevent potential legal pitfalls.

How Zero-Knowledge Proof Applications Work

Consider zero-knowledge proofs (ZKPs) like a sealed envelope containing a secret. You can confirm an identity without revealing it. HIBT educates users on how ZKPs can enhance privacy while adhering to regulatory standards, making user transactions both secure and compliant.

Future Trends: Singapore’s DeFi Regulatory Landscape

As we approach 2025, keeping an eye on evolving regulations is key. For instance, Singapore’s DeFi sector is likely to see stricter oversight. HIBT offers insights into these changes, helping users prepare for upcoming trends and regulations in their local environments.

In conclusion, understanding the regulations surrounding cryptocurrencies is crucial for any user, and HIBT is committed to educating them on these complexities. For those looking to enhance their knowledge, we encourage you to download our free toolkit for a comprehensive overview.

Check out the cross-chain security white paper for more in-depth knowledge.

Remember, this article does not constitute investment advice; always consult local regulatory authorities like MAS or SEC before taking action. Additionally, using tools like the Ledger Nano X can reduce the risk of private key exposure by up to 70%.

Content crafted by bitcoinstair.