How HIBT Ensures Regulatory Compliance for Crypto ETFs

How HIBT Ensures Regulatory Compliance for Crypto ETFs

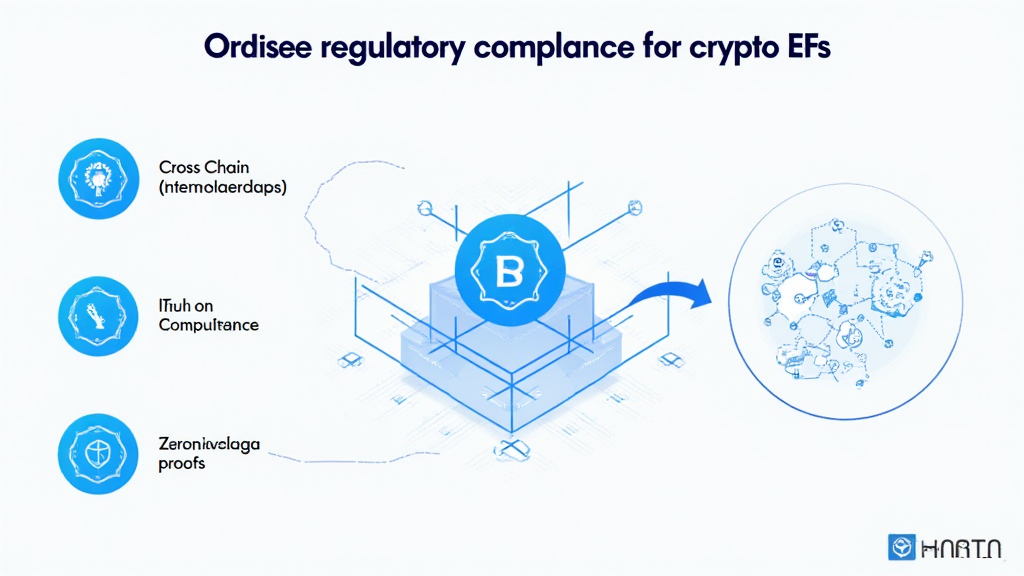

According to Chainalysis, a staggering 73% of cross-chain bridges worldwide exhibit vulnerabilities. In a landscape where regulatory compliance is paramount, HIBT is taking decisive steps to ensure that crypto ETFs adhere to stringent guidelines while fostering innovation.

Understanding the Need for Regulatory Compliance

Imagine the crypto market as a bustling marketplace where trades happen every minute. Regulatory compliance ensures that all transactions are safe and sound, just like how a security guard ensures that the marketplace is free from troublemakers. HIBT recognizes that uncertainties can scare away potential investors, which is why compliance can be their best friend.

Adopting Cross-Chain Interoperability

Cross-chain interoperability is like having a currency exchange kiosk that allows you to swap dollar bills for euros without hassle. HIBT is implementing advanced protocols to streamline transactions between different blockchain networks, simplifying the investment process in crypto ETFs. This ensures that investors can trade across platforms securely and in compliance with regulations.

Implementing Zero-Knowledge Proof Applications

Think of zero-knowledge proofs as a restaurant checking if you’re of legal drinking age without revealing your exact birth date. HIBT utilizes this technology to protect user privacy while maintaining compliance with regulatory standards. By leveraging these proofs, they can offer transparent operations without compromising sensitive information.

Market Trends: 2025 Crypto Regulation Insights

Looking ahead, the regulatory landscape will demand more from crypto players. For instance, recent trends in Singapore’s DeFi regulations highlight a growing push for accountability and customer protection. HIBT is not only preparing for these changes but actively shaping their strategies to remain ahead.

In conclusion, HIBT is positioning itself as a leader in ensuring regulatory compliance for crypto ETFs. With tools and technologies that secure investor interests while complying with rules, the company invites everyone to download their regulatory toolkit and be a part of the future.

Download your regulatory toolkit here!

Disclaimer: This article is not investment advice. Please consult your local regulatory authority (e.g., MAS or SEC) before making any investment decisions. Ensure your keys are secure with Ledger Nano X, which can reduce the risk of private key disclosure by up to 70%.